* See UPDATES below...

The following one-year charts and year-to-date percentages gained/lost graph show how much the 10 Technology stocks within the FNGU ETF have dropped during those periods.

META (Facebook) has lost the most, percentage-wise (70.51%), so far this year, followed by:

- NVDA (52.93%),

- NFLX (50.91),

- BIDU (47.21%),

- BABA (46.34%),

- AMZN (37.97%),

- TSLA (35.13%),

- GOOGL (33.53%),

- MSFT (29.41%), and

- AAPL (11.93%).

FNGU has, itself, lost 87.05% this year.

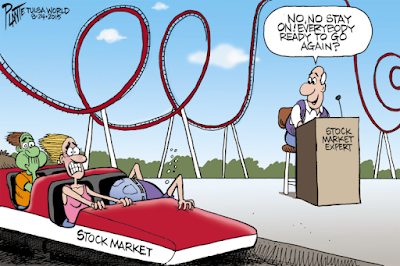

Further weakness in META could drag these stocks lower...one to watch...along with the VXN:NDX ratio, as described in my post of October 18.

META has been running in circles...and is back in 2016 territory...

P.S. Is AMZN next? Note the parabolic rise...usually followed by a similar plunge.

* UPDATE Oct. 31...

Oh my! 😲

No wonder the Biden administration does NOT want Republicans taking control of the House and Senate in the midterm elections...who will, surely, add this to their growing list of intended investigations!

* UPDATE Nov. 1...

Some interesting statistics...(N.B. TWTR was delisted from the NYSE on November 28, since it was privatized, following its sale to Elon Musk)...

* UPDATE Nov. 4...

Who wouldn't like to a fly on the wall during these upcoming depositions?

Things should get "interesting" as Americans finally get the transparency, to which they are fully entitled.

* UPDATE Nov. 6...

With META reportedly poised to announce thousands of job layoffs sometime this week, it should be a wild week in markets with all eyes on Tuesday's midterm election results...isn't it interesting that they're waiting until after that to announce! 🤔

* UPDATE Dec. 3...

More information on Elon Musk, his private purchase of Twitter, and his actions to make public Twitter's shocking suppression of free speech under its former executives and employees can be found here.