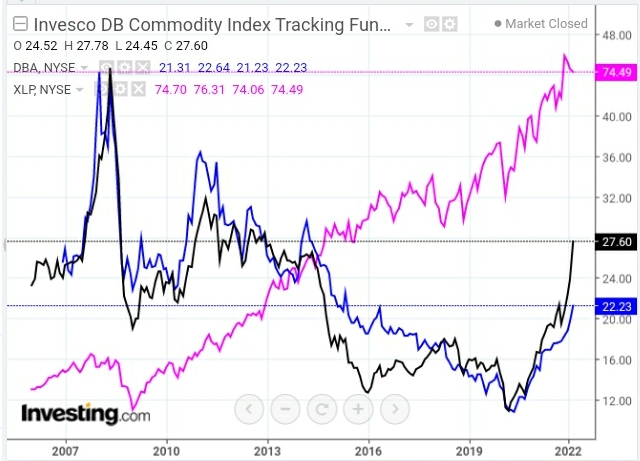

Following the bottoming of the 2008/09 U.S. financial crisis in March of 2009, the Consumer Staples ETF, XLP, began a years-long rally, along with the Commodities and Agricultural ETFs, DBC and DBA, respectively, as shown on the following monthly comparison chart.

While XLP has been on a slow, steady climb ever since, DBC and DBA began to diverge in a volatile and whippy descent in early 2011 and finally bottomed around late Q1 to early Q2 of 2020...then, reversed shortly after the WHO declared the COVID-19 virus a pandemic in March 2020).

DBC and DBA have been in an ever-steepening rally, ever since...likely accelerated most recently by Russia's declaration of war against and invasion of Ukraine.

As long as uncertainty exists around this war, as well as the after-effects of COVID, which have contributed to a spike in inflation, labour shortages, and supply-chain problems, I'd posit that all three ETFs will continue to rise.

However, a divergence in one or more may signal, either a pause and consolidation in these sectors for a period of time, or a reversal...so keep an eye on them for directional clues and trend strength, along with the information contained in my post of February 27 pertaining to U.S. Major Sectors and the SPX.