I last wrote about WTI Crude Oil in my post of September 12, 2021.

I identified price targets of 80.00 and 100.00, provided it broke and held above 70.00.

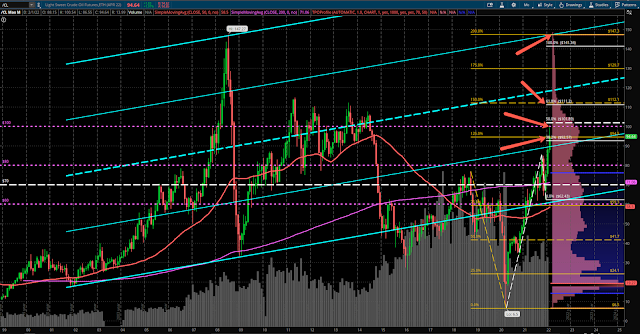

Following Russia's declaration of war and invasion last night of Ukraine, Oil hit 100.54 today, before falling back to close at 94.75...which is around a convergence point (lower red arrow) of a 40% Fibonacci Extension level with a 125% External Quadrant level, and is just above the bottom 1/4 of a long-term rising channel, as shown on the following monthly chart.

There is little price resistance above 100.00, as shown on the pink TPO Profile along the right-hand side of the chart.

Price targets are identified by the other three red arrows, which are also convergence points on the Fibonacci Extension with the External Quadrant. The highest red arrow also happens to converge with the upper 1/4 of the rising channel.

If price can remain above 90.00, it has a good chance of continuing its rally to these three targets, namely, 100.00, then 111.00-112.00, and then, ultimately, retesting its prior all-time high of 147.27.

Otherwise, a drop and hold below 90.00 could see a retest of 80.00, then 70.00, or lower.

At the moment, the "path of least resistance" is up.