* See UPDATES below...

IF there is an "old" Dow rule-breaker lurking about somewhere in the ether, then Monday's trading should not end in a "Crash."

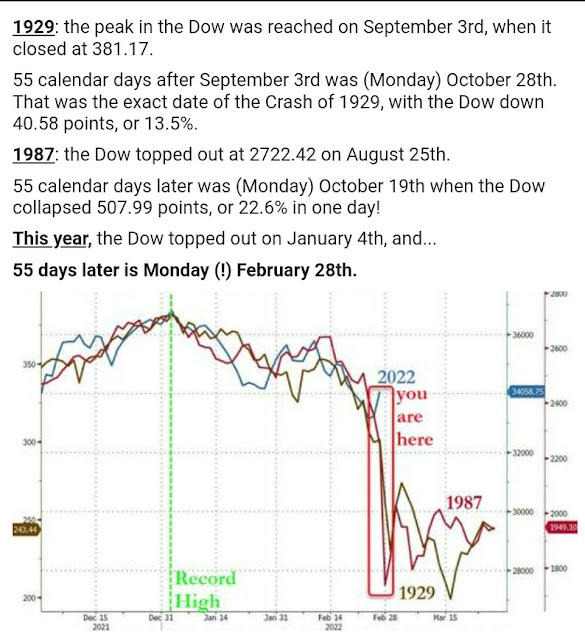

OTHERWISE...brace yourselves if history repeats itself, as described in the following ZeroHedge article.

BUT...although the Dow 30 Index closed at its all-time high on January 4, it reached an intraday all-time high on January 5...so, 55 calendar days later could put the "Crash" date forward by one day to March 1.

SO...either way, we may (or may not) see a "Crash" on Monday or Tuesday...depending on whether the "old" rule-breaker shows up. 😏

* UPDATE February 28...

No "Crash" today...

* UPDATE March 1...

No "Crash" today, either...the "Old Guy" (Fed Chairman Powell???) is still around, for now...we'll see how long that lasts.

P.S. By the way, Chair Powell looked nervous and stressed as he testified before the House Financial Services Committee on March 2.

His responses to various questions posed by Committee members pertining to rampant and rising inflation, as well as the oil and gas industry relative to Biden's climate change policies/agenda, sounded weak, wishy-wasy and ill-prepared.

It didn't sound like the Fed is prepared to act in any meaningful or serious way to quickly tamp down inflation and its destructive consequences. It appears that they are more concerned with keeping markets over-inflated at record levels than they are at deploying their monetary policies in a sound manner, as their mandate so requires (lacking or ignoring serious predictive warnings)...if they were, I doubt that inflation would have reached current levels.

So, I may not be wrong in assuming that the "Old Guy" who showed up in markets yesterday (and today) may, in fact, be Powell...or, rather his "silent influence."

MEANWHILE...U.S. equity markets are clinging to and threatening to break below major support...so, stay tuned as things heat up in global Oil markets...and other areas of concern in which the Fed may be ill-prepared to act in a timely, effective and prudent manner.