I last wrote about the SPX in my 2021 Market Wrap-Up and 2022 Forecast on January 1.

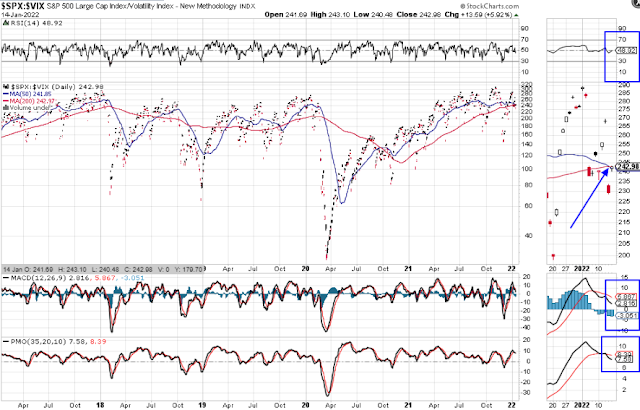

The SPX closed (around 20 points below the 50-day moving average) at 4662.85 last Friday, as shown on the following daily chart. The 200-day moving average is well below at 4420.84, which is slightly above the yearly Pivot Point for 2022 of 4412.61 (identified in my above-mentioned post). Both moving averages are still in uptrend.

The SPX uptrend is wavering and price is caught in a large and tightly bunched-up consolidation range.

It's a warning signal that weakness has crept into the SPX and we may see it pull back or correct soon.

A 10% drop would send it down to 4200, while a 20% drop would take it to 3730.

Alternatively, it may be a bear trap.

These two scenarios should become more clearly defined after the next Fed meeting on January 26.

In the meantime, trading will likely remain volatile and whippy...especially below 4700.