* See UPDATES below...

The price of

Gasoline RBOB Futures is coming to a head in this large triangle formation, as shown on the following

Monthly chart.

Watch for a breakout and hold above its apex around the

1.6445 level, together with a new swing high on the Momentum indicator, to confirm sustainable bullish sentiment.

* UPDATE August 31...

The August candle broke out above the triangle apex (noted above) and closed today near its high of

1.7828 at

1.7796, as shown on the following following

Monthly chart of

Gasoline RBOB Futures. September's candle is just beginning to form, as you can see in after-hours trading tonight.

This candle confirms the bullish engulfing formation involving June and July's candles. Watch for a breakout and hold above

1.7828 for a potential run up to

2.00, or higher, together with continued rising Momentum and Rate of Change indicators (both of which made a higher swing high in August).

Failure to to do so, could see a retest of

1.50, or lower.

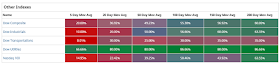

The following

Year-to-Date and

2-Week graphs show which

commodities (and commodity ETFs) have gained and lost the most (in terms of percentage) during those two time periods.

The second graph illustrates the massive

18.92% gains made in

Gasoline during these

past two weeks...no doubt, in anticipation of, and with respect to, current events surrounding the refinery shut-downs in Texas this week, due to the effects of Hurricane Harvey.

On a

Year-to-Date basis, the

laggards are WTIC Crude Oil, Brent Crude Oil, and the Agriculture ETF, while Copper leads in

gains, followed by other metals.

The following

1-Year charts of these seven

commodities and two

ETFs show that all of these are mired within prior price resistance zones, except for the Agriculture ETF (

DBA), and

Copper, which are at their respective low or high points (and in their well-defined down or up trends) during this time period.

These are two to watch, along with

WTIC Crude Oil,

Brent Crude Oil and

Gasoline, in the coming days and weeks for signs of, either, trend reversal, or, continuation.

* UPDATE September 7...

The August candle did, indeed, exceed the

2.00 level and made a new high of

2.1705, (together with new swing highs on the momentum and rate of change indicators) for 2017, as shown on the

Monthly chart below of

Gasoline RBOB Futures.

However, the price on the September candle gapped down quite a bit on its open, but is still trading above its apex (as noted above) of

1.6445...a level to watch and see if price can remain above to, potentially, retest its August high, or move even higher.