Pages

▼

Thursday, December 31, 2015

Happy New Year 2016!

I'd like to wish all of my readers, the hosts of all the websites who publish my articles, and those who generously provide a link from their trading Blog to mine, a very safe and Happy New Year 2016! May all your dreams come true...

Tuesday, December 29, 2015

Market Forecast for 2016: Debt Bubbles and Volatility

As a contributing writer at Investing.com, I'm pleased to announce that they invited me, once again, to participate and share my views on where the markets may be headed for 2016. FYI, you can read what I wrote a year ago, as to what I projected for 2015, here.

As a contributing writer at Investing.com, I'm pleased to announce that they invited me, once again, to participate and share my views on where the markets may be headed for 2016. FYI, you can read what I wrote a year ago, as to what I projected for 2015, here.I wrote the following article on December 7th: Market Forecast for 2016 -- Debt Bubbles and Volatility. It was published on their website on December 29th and may now be read at this link.

Good luck to all next year!

* For your easy reference, I've re-printed my article (originally written on December 7th), as follows...

What would cause retail and proprietary trading banks to tighten lending and begin to call in their loans?...possibly a major "accidental international incident" in the (internationally-crowded) Middle East, involving Russia and the West/Europe and/or Middle-Eastern countries? In such a scenario, we may see the price of Oil and Gold spike, contrasting with a major world-wide sell-off in bank stocks, in particular, along with equity stocks, in general. The markets in the U.S. could be especially hit hard, inasmuch as 68.4% of its GDP was comprised of personal consumption expenditures in Q3 of 2015 (it has averaged around 68% since 2008). The question becomes, would banks pass a stress test under those circumstances?

Until then, I think we'll see world Central Bankers continue to inflate equity markets and influence currencies by keeping interest rates low (or relatively low), thereby keeping Oil and Gold prices depressed -- which, then, keeps inflation low -- which, in their minds, could serve to validate their reasons for maintaining low interest rates and/or some form(s) of Quantitative Easing -- perpetuating this never-ending cycle of low economic growth, in which we seem to be stuck and, which, world governments seem to be incapable of, or unwilling to, address.

The question, then, becomes how much could markets advance next year, if a major international incident did not occur? Possibly around 5-6% -- a bit higher than this year's increase, which peaked (as of today's writing of this article...December 7th) at its (daily closing) high of 3.49% on May 21st -- in a potential run-up to the U.S. presidential election to be held on November 8th.

In that case, I'd keep an eye on the Technology Sector and Cyclicals to continue to outperform other sectors in the U.S. and to see if the Financials Sector begins to, substantially, firm up, along with the Industrials Sector. Otherwise, we may only see a repeat of 2015 and achieve around a 4% increase, or less, for 2016. Here's how they've performed, so far this year, as shown on the following Year-to-Date graph of the 9 Major Sectors...

Regarding the Financials Sector, the following three Daily ratio charts are worth noting...they show the strength/weakness of the:

- XLF (U.S. Financials ETF) compared to $SPX

- EUFN (European Financials ETF) compared to $STOX50

- GXC (Chinese Financials ETF) compared to $SSEC

Each chart shows that price is trading at or near major price resistance and their converging 50 and 200 MAs, and that all of these financial sectors are currently weaker than their country's counterpart Major Index...the last two at a considerable discount. Unless we see all three of these firm up and outpace their major indices, I doubt we'll see that 5-6% potential target increase achieved in U.S. equities.

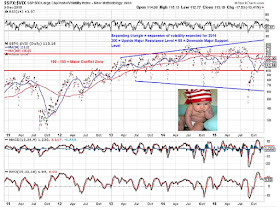

In any event, as mentioned in my post of December 3rd, I'll re-iterate that, "I think 2016 will see greater volatility and much larger swings than we've seen this year." My comments and chart contained therein still apply (and are worth monitoring, along with the above charts and graph, over the coming weeks and months) regarding major resistance and support levels on the SPX:VIX ratio and equity market follow-through.

Tuesday, December 22, 2015

Coping With Losses -- In Life and In Trading (REPOST)

SB's note: I originally wrote this post on February 24, 2013, but thought I'd share it again as we approach the end of 2015...and to wish a Happy Holidays to all...

Sunday, December 20, 2015

Markets Bottoming or Simply Short Covering?

Markets that have rallied the most (within their respective groups) on a percentage basis this past week (showing percentage-gained above the zero level, as opposed to most of them being in the percentage-lost category, on a Year-to-Date basis):

Dow Utilities

Portugal

Greece

EEM (Emerging Markets ETF)

China's Shanghai Index

Canada's TSX Index

Austrailia's AORD Index

Platinum

Oil

Silver

Lumber

U.S. $

Blackberry

So, the questions is, is this a serious attempt to bottom out, or simply some short-covering before the end of the year? Their performance next year may hold the key to overall global strength or weakness...particularly, Oil, the U.S. $, Emerging Markets, and China.

Dow Utilities

Portugal

Greece

EEM (Emerging Markets ETF)

China's Shanghai Index

Canada's TSX Index

Austrailia's AORD Index

Platinum

Oil

Silver

Lumber

U.S. $

Blackberry

So, the questions is, is this a serious attempt to bottom out, or simply some short-covering before the end of the year? Their performance next year may hold the key to overall global strength or weakness...particularly, Oil, the U.S. $, Emerging Markets, and China.

Wednesday, December 09, 2015

What's in Store for AAPL?

$95.00 or $85.00 target?...both are major support levels, as shown on the Weekly chart below.

So far, price has been unable to break above major resistance (with volatility increasing within a broadening triangle formation), so it suggests that a top may be forming with further downside to follow.

So far, price has been unable to break above major resistance (with volatility increasing within a broadening triangle formation), so it suggests that a top may be forming with further downside to follow.

Tuesday, December 08, 2015

Further Downside Likely for Foreign ETFs

One gauge of market sentiment that I look at from time to time is my chartgrid of Foreign ETFs, showing the daily ATR on each ETF (the white histogram at the bottom of each ETF)...an extreme high ATR can often signal capitulation and a reversal of recent general trend.

From the chartgrid below, we're not seeing that extreme, yet. In my opinion, we could very well see further downside on these ETFs, in general, for awhile longer.

From the chartgrid below, we're not seeing that extreme, yet. In my opinion, we could very well see further downside on these ETFs, in general, for awhile longer.

Monday, December 07, 2015

Is Oil Set to Bounce?

The following 5-Year Daily chart depicts Light Crude Oil (as the primary instrument in candle format) and the S&P 500 Index (as the secondary instrument shown as a black line). There was a drastic shift in sentiment between these two markets when they began to diverge in mid-October, 2014.

While the price of Oil is making lower swing lows in its depressed downtrend -- and, in fact, made a new 5-year low today (December 7th) -- the RSI and PMO indicators have been making higher swing lows but have yet to make higher swing highs. So, while we're seeing possible hints of higher prices to come at some point in the future, it may be awhile yet before prices begin to stabilize, first.

High-than-normal volumes this year haven't yet produced stable prices and may have contributed to the large swings in between 37.50 and 62.50 that we've been seeing. Until we see a sustained drop in volumes, we will likely see Oil continue to plunge to further new lows and/or persist in its wild daily erratic bearish and bullish spikes.

While the price of Oil is making lower swing lows in its depressed downtrend -- and, in fact, made a new 5-year low today (December 7th) -- the RSI and PMO indicators have been making higher swing lows but have yet to make higher swing highs. So, while we're seeing possible hints of higher prices to come at some point in the future, it may be awhile yet before prices begin to stabilize, first.

High-than-normal volumes this year haven't yet produced stable prices and may have contributed to the large swings in between 37.50 and 62.50 that we've been seeing. Until we see a sustained drop in volumes, we will likely see Oil continue to plunge to further new lows and/or persist in its wild daily erratic bearish and bullish spikes.

Thursday, December 03, 2015

2015 Market Volatility is About to Get Wilder for 2016

I can't get too excited about possible market follow-through in any one direction on the S&P 500 Index unless and until price breaks and holds either above 150 or below 100 on the SPX:VIX Daily ratio chart below.

Currently, price is still in what I call the "Major Conflict Zone." Yes, I realize it's a huge range, but that's the way 2015 has gone. In my opinion, I think 2016 will see greater volatility and much larger swings than we've seen this year...hang onto your (Santa) hats, folks!

Currently, price is still in what I call the "Major Conflict Zone." Yes, I realize it's a huge range, but that's the way 2015 has gone. In my opinion, I think 2016 will see greater volatility and much larger swings than we've seen this year...hang onto your (Santa) hats, folks!

Tuesday, December 01, 2015

Is Europe Really the Loser for 2015?

At 7:45 am ET on Thursday, December 3rd, markets will know what the ECB will do with its interest rates until its next meeting in 2016. Mario Draghi will give a press conference at 8:30 am ET to explain the details.

Based on the Year-to-Date graph below, which shows how Europe's Major Indices have fared compared with U.S. Major Indices in 2015, I'd wonder why the ECB would think that it has to pour on more QE stimulus, as many media pundits are predicting...we'll see what happens.

Based on the Year-to-Date graph below, which shows how Europe's Major Indices have fared compared with U.S. Major Indices in 2015, I'd wonder why the ECB would think that it has to pour on more QE stimulus, as many media pundits are predicting...we'll see what happens.

Saturday, November 28, 2015

China's Shanghai Index: A Bounce Next is Critical for Bulls

Further to my post of November 17th, a bounce next (at the 40 MA...3433) and sustained rally to new highs, thereafter, is critical for China's Shanghai Index.

Otherwise, a break and hold below the 40 MA will signal that the bearish scenario (that I outlined in the above post) is imminent, in my opinion...all three indicators on the Daily chart below of SSEC now display "SELL" signals.

Otherwise, a break and hold below the 40 MA will signal that the bearish scenario (that I outlined in the above post) is imminent, in my opinion...all three indicators on the Daily chart below of SSEC now display "SELL" signals.

Wednesday, November 18, 2015

Political Unity...An Oxymoron

Some things never change...I wonder if they ever will? Case in point, my post of November 7th, 2012...still seems relevant today, except the U.S. National Debt has now reached $18.6 Trillion and there are even deeper differences, not only between Democrats and Republicans, but also within these parties (on issues such as the refugee crisis, as one example).

I repeat:

I repeat:

"The war between its own political parties is a greater threat to America

than any threat from its enemies."

I've stopped hoping and am simply waiting to see action now...but am not holding my breath on this...perhaps the next generation will figure things out if ours isn't smart enough to do so...some legacy, eh?

Tuesday, November 17, 2015

Third Major Leg Down Ahead For Shanghai Index?

You can see my original post of July 8th and four subsequent updates covering China's Shanghai Index here for background information.

In my last update of September 8th, I noted that a bearish moving average Death Cross had formed on the Daily chart and price closed at 3170.45. Since that date, price moved sideways for over a month before it, finally, rallied to where it closed today (Tuesday) at 3604.80.

I have the following observations on the 2-year Daily chart below:

In my last update of September 8th, I noted that a bearish moving average Death Cross had formed on the Daily chart and price closed at 3170.45. Since that date, price moved sideways for over a month before it, finally, rallied to where it closed today (Tuesday) at 3604.80.

I have the following observations on the 2-year Daily chart below:

- both gaps down in August have now been filled

- a bearish Head & Shoulders has formed on the MACD Histogram, hinting of weakness ahead

- price is approaching a triple confluence major resistance level around 3750 (comprised of the 200 MA, major downtrend line, and a 40% Fibonacci retracement level)

- a re-test of a 200 MA is not uncommon after a Death Cross has formed and price usually drops afterwards, often to new lows

I wouldn't be surprised to see some major selling come in sometime soon on this index to, possibly, take price down to around 2500, or lower (what would be Wave 5 for Elliott Wave enthusiasts).

Friday, November 13, 2015

S&P 500 Index: Naughty or Nice?

The Momentum indicator has crossed below the zero level on the following Monthly chart of the S&P 500 Index (SPX), hinting of further weakness ahead.

Major support sits around the 1700 level (confluence of the 50 MA and the 40% Fibonacci retracement level -- taken from the October 2011 lows).

Price on the following Monthly ratio chart of the SPX:VIX rallied at the end of today (Friday) to close just above the 100 level -- which is a major bull/bear line-in-the-sand level -- and, about which, I've written in numerous posts here.

The Momentum indicator is still well below the zero level, also hinting of further weakness ahead for the SPX.

Price on the following Daily chart of the World Market Index did eventually drop to re-test the 1600 level, which was mentioned as a possibility in my above-referenced posts. It, subsequently, bounced and has now fallen back and closed below what was near-term major price support (now major resistance) at 1700 and the 200 MA.

Unless we see price rally and the RSI climb back (and stay) above the 50 level, we could very well see this Index plunge back to 1600, or lower. As of now, all three indicators on this chart contain "SELL" signals...and, in fact, the RSI has now broken its recent uptrend, which, also, suggests further weakness to follow.

Unless we see major buying step in soon for the SPX and the World Market Index, equity markets may very well be in for a lump of coal for Xmas -- and, my 2015 Market Forecast may prove to be fairly accurate -- as of today, there are only six weeks until then.

These three charts should provide clues as to any strengthening or continued weakness in the coming days/weeks.

Major support sits around the 1700 level (confluence of the 50 MA and the 40% Fibonacci retracement level -- taken from the October 2011 lows).

Price on the following Monthly ratio chart of the SPX:VIX rallied at the end of today (Friday) to close just above the 100 level -- which is a major bull/bear line-in-the-sand level -- and, about which, I've written in numerous posts here.

The Momentum indicator is still well below the zero level, also hinting of further weakness ahead for the SPX.

Price on the following Daily chart of the World Market Index did eventually drop to re-test the 1600 level, which was mentioned as a possibility in my above-referenced posts. It, subsequently, bounced and has now fallen back and closed below what was near-term major price support (now major resistance) at 1700 and the 200 MA.

Unless we see price rally and the RSI climb back (and stay) above the 50 level, we could very well see this Index plunge back to 1600, or lower. As of now, all three indicators on this chart contain "SELL" signals...and, in fact, the RSI has now broken its recent uptrend, which, also, suggests further weakness to follow.

Unless we see major buying step in soon for the SPX and the World Market Index, equity markets may very well be in for a lump of coal for Xmas -- and, my 2015 Market Forecast may prove to be fairly accurate -- as of today, there are only six weeks until then.

These three charts should provide clues as to any strengthening or continued weakness in the coming days/weeks.

Sunday, October 11, 2015

"World Population Aging: Clocks Illustrate Growth in Population Under Age 5 and Over Age 65"

Wonder no more as to why global economic conditions are slowing down...this article, courtesy of

Carl Haub of the Population Reference Bureau, offers an excellent explanation [which re-enforces what I've previously said about Baby Boomers (downsizing) here and here]...

"World Population Aging: Clocks Illustrate Growth in Population Under Age 5 and Over Age 65"

I think the U.S. Fed's mandate to tie a 2% inflation target to their timing of a rise in interest rates is outdated and too high and needs to be seriously re-visited, in view of these facts.

Carl Haub of the Population Reference Bureau, offers an excellent explanation [which re-enforces what I've previously said about Baby Boomers (downsizing) here and here]...

"World Population Aging: Clocks Illustrate Growth in Population Under Age 5 and Over Age 65"

I think the U.S. Fed's mandate to tie a 2% inflation target to their timing of a rise in interest rates is outdated and too high and needs to be seriously re-visited, in view of these facts.

Thursday, October 08, 2015

Death Cross Formation on Japan's Nikkei Index

Notwithstanding the bearish moving average Death Cross that has now formed on the Japanese Nikkei Index, all three indicators are hinting of higher prices, as shown on the 5-year Daily chart below.

At the moment, major resistance sits at 19000, while minor support is at 17000, with major support at 16000. I'd watch the RSI, in particular, to see whether it can rise (and stay) above the 50.00 level. If so, we may see price spike to 19000 before consolidating -- then, either, attempt to penetrate above (and reverse) the moving average cross-over and rally to, potentially, new highs, or drop to new lows around the 16000 level. Otherwise, a hold below 50.00 on the RSI may see price plunge as low as 16000 (or lower), first.

At the moment, major resistance sits at 19000, while minor support is at 17000, with major support at 16000. I'd watch the RSI, in particular, to see whether it can rise (and stay) above the 50.00 level. If so, we may see price spike to 19000 before consolidating -- then, either, attempt to penetrate above (and reverse) the moving average cross-over and rally to, potentially, new highs, or drop to new lows around the 16000 level. Otherwise, a hold below 50.00 on the RSI may see price plunge as low as 16000 (or lower), first.

Friday, September 25, 2015

Fed "Double-Talk"

Just to add to confusion regarding what future direction the FOMC may take regarding whether or not to raise interest rates in 2015, we see this tweet last night...

I would just remind readers that Janet Yellen's comments last night are HER comments and are NOT the official Fed Policy Statement that was released at their last meeting on September 17th. In their Release, they stated that...

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term."

I would just remind readers that Janet Yellen's comments last night are HER comments and are NOT the official Fed Policy Statement that was released at their last meeting on September 17th. In their Release, they stated that...

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term."

AND...

"To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term."

AND...

"The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

In my opinion, regardless of what Janet Yellen or any other FOMC member (or media pundit) may say in between their last Fed meeting and the next one, the only one that could be considered the official FOMC policy at the moment, is the one stated in their last meeting.

Monday, September 21, 2015

Thursday, September 17, 2015

What Is The Fed REALLY Saying?

Is the Fed really saying that their present economic monetary policy dictates that they treat current economic conditions like they had to in March of 2009 (re: their decision today to leave Fed Funds Rate unchanged at zero to 1/4 percent)?

If so, then what does that say about the health of U.S. banks? Does that mean they're at the same stress levels as they were in 2009?

If so, then one could rationally conclude that the S&P 500 Index should not be trading 1,323 points higher than it was at the March 2009 lows, as shown on the Monthly chart of the SPX below.

The message I'm seeing on the following Monthly ratio chart of SPX:VIX indicates that the current fear level of market participants equals that experienced back in April of 2011, when the SPX was trading at 1364 before it tumbled to 1074 and, eventually, rallied steadily to reach all-time highs earlier this year.

CONCLUSIONS:

Both, today's message from the Fed and information on the SPX:VIX ratio chart, are telling me that the current valuation of the SPX (at 1990) is far above where it should be. My comments (and subsequent UPDATES) noted in this previous post regarding the SPX:VIX ratio still apply and are worth monitoring over the coming days and weeks.

* Tweeted by BNN's Andrew McCreath September 18th:

If so, then what does that say about the health of U.S. banks? Does that mean they're at the same stress levels as they were in 2009?

If so, then one could rationally conclude that the S&P 500 Index should not be trading 1,323 points higher than it was at the March 2009 lows, as shown on the Monthly chart of the SPX below.

The message I'm seeing on the following Monthly ratio chart of SPX:VIX indicates that the current fear level of market participants equals that experienced back in April of 2011, when the SPX was trading at 1364 before it tumbled to 1074 and, eventually, rallied steadily to reach all-time highs earlier this year.

CONCLUSIONS:

Both, today's message from the Fed and information on the SPX:VIX ratio chart, are telling me that the current valuation of the SPX (at 1990) is far above where it should be. My comments (and subsequent UPDATES) noted in this previous post regarding the SPX:VIX ratio still apply and are worth monitoring over the coming days and weeks.

* Tweeted by BNN's Andrew McCreath September 18th:

Sunday, September 06, 2015

Will Markets Take On More Risk?

The following 1-Year Daily comparison chart has the Dow 30 plotted on as the baseline. You can see that the SPX, NDX & RUT have, for the most part, outperformed the Dow this year.

We'll see if market participants are willing to keep buying into riskier assets in the NDX and RUT (since they're currently outpacing the SPX), or whether money will start flowing back into the larger-cap stocks.

My own feeling is that if (big) money starts fleeing the NDX and RUT (risk), we could, finally, see the SPX and Dow (and other world markets) follow...especially, emerging markets, Japan and China. So, I'd watch for any signs of fresh, large-scale dumping of "risk" on this comparison chart.

With the VIX currently elevated and sitting just above major support (the zone between 20.00 and 25.00), we could, very well, see some large-scale risk-dumping occur (with continued wild, volatile price swings) before markets settle down (when the VIX falls back below 20.00).

We'll see if market participants are willing to keep buying into riskier assets in the NDX and RUT (since they're currently outpacing the SPX), or whether money will start flowing back into the larger-cap stocks.

My own feeling is that if (big) money starts fleeing the NDX and RUT (risk), we could, finally, see the SPX and Dow (and other world markets) follow...especially, emerging markets, Japan and China. So, I'd watch for any signs of fresh, large-scale dumping of "risk" on this comparison chart.

With the VIX currently elevated and sitting just above major support (the zone between 20.00 and 25.00), we could, very well, see some large-scale risk-dumping occur (with continued wild, volatile price swings) before markets settle down (when the VIX falls back below 20.00).

Saturday, September 05, 2015

Will Japan & China Lead Markets Back Up?

How strong is Japanese influence on U.S. markets?

Will the Shanghai Index regain strength on Monday?

Without U.S. markets opening until Tuesday, we may see an attempt by Japan's Nikkei Index and China's Shanghai Index to bounce somewhat. It may not become clear until Tuesday's close as to the potential strength of any sustainable rally in these Indices, along with the S&P 500 Index. Furthermore, there are quite a lot of economic reports being released on Monday for Japan and China, which may influence Tuesday's trading.

I'd keep a close eye on these three Indices, along with the USD:JPY forex pair, which have all traded lock-step (as shown on the following 1-Year Daily comparison chart), as to which direction the next (sustainable) breakout will occur.

Will the Shanghai Index regain strength on Monday?

Without U.S. markets opening until Tuesday, we may see an attempt by Japan's Nikkei Index and China's Shanghai Index to bounce somewhat. It may not become clear until Tuesday's close as to the potential strength of any sustainable rally in these Indices, along with the S&P 500 Index. Furthermore, there are quite a lot of economic reports being released on Monday for Japan and China, which may influence Tuesday's trading.

I'd keep a close eye on these three Indices, along with the USD:JPY forex pair, which have all traded lock-step (as shown on the following 1-Year Daily comparison chart), as to which direction the next (sustainable) breakout will occur.

Monday, August 31, 2015

Higher Prices in Store for Crude Oil?

* See UPDATE below...

The last three-day candle pattern on WTIC Crude Oil could very end up being a "Three White Soldiers" pattern, which is, technically, bullish [Definition (courtesy of StockCharts.com): "Three White Soldiers: A bullish reversal pattern consisting of three consecutive white bodies, each with a higher close. Each should open within the previous body and the close should be near the high of the day."]

If that's the case, we may see Oil continue to the next major resistance level around $54.00-55.00 (confluence of the 200 MA on the Daily chart and the Mid-Bollinger Band & upper Channel on the Weekly chart) before, either consolidating, or reversing; otherwise, a reversal here could send it down to around $45.00 or $42.50, or lower.

* UPDATE September 1, 2015:

Well, just like the action in the game, Pac-Man, WTIC Crude Oil just ate the third "White Soldier" and made inroads on the second one in today's wild 8.24% plunge, after it was rejected at the falling 50 MA.

$45.00 is now resistance and $42.50 is the next support level...a drop below that could send price to new lows for this year.

The last three-day candle pattern on WTIC Crude Oil could very end up being a "Three White Soldiers" pattern, which is, technically, bullish [Definition (courtesy of StockCharts.com): "Three White Soldiers: A bullish reversal pattern consisting of three consecutive white bodies, each with a higher close. Each should open within the previous body and the close should be near the high of the day."]

|

| "Three White Soldiers" candle pattern |

If that's the case, we may see Oil continue to the next major resistance level around $54.00-55.00 (confluence of the 200 MA on the Daily chart and the Mid-Bollinger Band & upper Channel on the Weekly chart) before, either consolidating, or reversing; otherwise, a reversal here could send it down to around $45.00 or $42.50, or lower.

|

| WTIC Crude Oil 9 Months Daily Chart |

|

| WTIC Crude Oil 5 Years Daily Chart |

|

| Crude Oil Weekly Chart |

* UPDATE September 1, 2015:

Well, just like the action in the game, Pac-Man, WTIC Crude Oil just ate the third "White Soldier" and made inroads on the second one in today's wild 8.24% plunge, after it was rejected at the falling 50 MA.

$45.00 is now resistance and $42.50 is the next support level...a drop below that could send price to new lows for this year.

|

| WTIC Crude Oil 9 Months Daily Chart |

Thursday, August 27, 2015

What's Still "UP" on the Year?

After the market pullback that we've seen, of late, I thought I'd simply post the following Year-to-Date percentage-gained/lost graphs of a variety of world markets, to illustrate (at a glance) which ones are still "up" on the year (as of their close on Wednesday, August 26th)...presented without individual comment.

They can be monitored to see if they strengthen or weaken over the coming days/weeks, as a possible gauge of general sentiment for the remainder of the markets, particularly, those markets that have lost the most ground this year.

They can be monitored to see if they strengthen or weaken over the coming days/weeks, as a possible gauge of general sentiment for the remainder of the markets, particularly, those markets that have lost the most ground this year.

|

| U.S. Major Indices |

|

| U.S. 9 Major Sectors |

|

| Germany, France + PIIGS Countries |

|

| Emerging Markets ETF + BRIC Countries + BRIC ETF |

|

| Canada, Japan, UK, Australia + World Market Index |

|

| Commodities, Homebuilders ETF, U.S. $ + U.S. Bonds |

|

| Currencies |

Wednesday, August 26, 2015

Will GOLD and PLATINUM Make a Comeback?

SPX vs SSEC vs USD:JPY

Notice the correlation among these three instruments...namely, SPX (S&P 500 Index) vs SSEC (Shanghai Index) vs USD:JPY (U.S. $ & Japanese Yen Forex pair).

They've pretty much moved in tandem for several years, now...until very recently, when the SSEC plunged to a much greater extent than the other two, and the U.S. $/Yen Forex pair a bit stronger than the SPX.

I'd keep a close eye on the SSEC for any signs of recovery, and, if there's none soon, we may see another (substantial) leg down on that, with, possibly, SPX and USD:JPY following suit. (You can read further details on the SSEC here at this link.)

They've pretty much moved in tandem for several years, now...until very recently, when the SSEC plunged to a much greater extent than the other two, and the U.S. $/Yen Forex pair a bit stronger than the SPX.

I'd keep a close eye on the SSEC for any signs of recovery, and, if there's none soon, we may see another (substantial) leg down on that, with, possibly, SPX and USD:JPY following suit. (You can read further details on the SSEC here at this link.)

Thursday, August 20, 2015

SPX:VIX Ratio At The Brink

* N.B. See Friday's & Monday's UPDATES below...

Thursday, August 20th:

Note the aggressive selling on the SPX when the SPX:VIX ratio gets up to the 180 level. A drop and hold below the 100 major support level could spell big trouble for the SPX and the other Major U.S. Indices.

With the Momentum indicator in a downtrend on this timeframe, I wouldn't be surprised to see a larger pullback occur in the equity markets. Watch the 2038 level on the SPX, as mentioned in my post of August 14th, for confirmation.

As well, we should see a bearish moving average Death Cross form on the World Market Index, possibly as soon as tomorrow's (Friday's) close...see my post of August 19th for more information on this, as this (along with upcoming action in Chinese markets) could very well weigh heavily on U.S. markets.

* UPDATE Friday, August 21st:

Failure to hold the 60.00 level on the SPX:VIX ratio chart could cause some panic selling in equities, as I mentioned in last year's post of October 15th, 2014. Price closed just above 70.00 today (Friday), as shown on the following Monthly chart. The Momentum indicator is now sitting at the lowest levels seen in the past 20 years...an ominous sign of things to come.

As far as the World Market Index is concerned, price fell further today, but I was a day early in the bearish moving average Death Cross formation -- that will likely happen on Monday -- forecasting another "sell" signal for world equity markets.

* UPDATE Monday, August 24th:

Here's a look at how World Market Indices closed today...the selloff began overnight in Asia and continued into the rest of world equity markets, where, approximately, $5 Trillion in profits were wiped out.

Price closed today well below the 60.00 major support level (mentioned above)...and, as you can see from the data above, the percentage world market selloff was considerable, including that of the U.S. equity markets. Look for more of the same, as long as price on this ratio chart remains anywhere below the 110.00 - 60.00 range...the Momentum indicator continued its plunge to even lower 20-year levels, as well, today, to signal more volatility and weakness ahead for the SPX.

We finally saw a bearish moving average Death Cross form today on the World Market Index, forecasting further weakness and another "sell" signal for world equity markets.

Price has dropped below its first major support level of 1700 and appears to be headed towards the next one at 1600. Whether this continues to plunge without a small bounce in between remains to be seen.

I'd also include the following 1-Year Daily chartgrid of Foreign ETFs. The daily ATRs (average trading ranges) are shown in white along the bottom of each chart. Today's extreme spike in range tells me that we are seeing the beginnings of major volatility and weakness entering these ETFs...confirming what the above charts are forecasting.

Thursday, August 20th:

Note the aggressive selling on the SPX when the SPX:VIX ratio gets up to the 180 level. A drop and hold below the 100 major support level could spell big trouble for the SPX and the other Major U.S. Indices.

With the Momentum indicator in a downtrend on this timeframe, I wouldn't be surprised to see a larger pullback occur in the equity markets. Watch the 2038 level on the SPX, as mentioned in my post of August 14th, for confirmation.

|

| SPX:VIX Monthly Ratio Chart |

As well, we should see a bearish moving average Death Cross form on the World Market Index, possibly as soon as tomorrow's (Friday's) close...see my post of August 19th for more information on this, as this (along with upcoming action in Chinese markets) could very well weigh heavily on U.S. markets.

|

| World Market Index Daily chart |

* UPDATE Friday, August 21st:

Failure to hold the 60.00 level on the SPX:VIX ratio chart could cause some panic selling in equities, as I mentioned in last year's post of October 15th, 2014. Price closed just above 70.00 today (Friday), as shown on the following Monthly chart. The Momentum indicator is now sitting at the lowest levels seen in the past 20 years...an ominous sign of things to come.

|

| SPX:VIX Monthly Ratio Chart |

As far as the World Market Index is concerned, price fell further today, but I was a day early in the bearish moving average Death Cross formation -- that will likely happen on Monday -- forecasting another "sell" signal for world equity markets.

|

| World Market Index Daily chart |

* UPDATE Monday, August 24th:

Here's a look at how World Market Indices closed today...the selloff began overnight in Asia and continued into the rest of world equity markets, where, approximately, $5 Trillion in profits were wiped out.

|

| World Market Indices |

Price closed today well below the 60.00 major support level (mentioned above)...and, as you can see from the data above, the percentage world market selloff was considerable, including that of the U.S. equity markets. Look for more of the same, as long as price on this ratio chart remains anywhere below the 110.00 - 60.00 range...the Momentum indicator continued its plunge to even lower 20-year levels, as well, today, to signal more volatility and weakness ahead for the SPX.

|

| SPX:VIX Monthly Ratio Chart |

We finally saw a bearish moving average Death Cross form today on the World Market Index, forecasting further weakness and another "sell" signal for world equity markets.

Price has dropped below its first major support level of 1700 and appears to be headed towards the next one at 1600. Whether this continues to plunge without a small bounce in between remains to be seen.

|

| World Market Index Daily chart |

I'd also include the following 1-Year Daily chartgrid of Foreign ETFs. The daily ATRs (average trading ranges) are shown in white along the bottom of each chart. Today's extreme spike in range tells me that we are seeing the beginnings of major volatility and weakness entering these ETFs...confirming what the above charts are forecasting.

|

| Foreign ETFs 1-Year Daily charts |