As a contributing writer at Investing.com, I'm pleased to announce that they invited me, once again, to participate and share my views on where the markets may be headed for 2016. FYI, you can read what I wrote a year ago, as to what I projected for 2015, here.

As a contributing writer at Investing.com, I'm pleased to announce that they invited me, once again, to participate and share my views on where the markets may be headed for 2016. FYI, you can read what I wrote a year ago, as to what I projected for 2015, here.I wrote the following article on December 7th: Market Forecast for 2016 -- Debt Bubbles and Volatility. It was published on their website on December 29th and may now be read at this link.

Good luck to all next year!

* For your easy reference, I've re-printed my article (originally written on December 7th), as follows...

What would cause retail and proprietary trading banks to tighten lending and begin to call in their loans?...possibly a major "accidental international incident" in the (internationally-crowded) Middle East, involving Russia and the West/Europe and/or Middle-Eastern countries? In such a scenario, we may see the price of Oil and Gold spike, contrasting with a major world-wide sell-off in bank stocks, in particular, along with equity stocks, in general. The markets in the U.S. could be especially hit hard, inasmuch as 68.4% of its GDP was comprised of personal consumption expenditures in Q3 of 2015 (it has averaged around 68% since 2008). The question becomes, would banks pass a stress test under those circumstances?

Until then, I think we'll see world Central Bankers continue to inflate equity markets and influence currencies by keeping interest rates low (or relatively low), thereby keeping Oil and Gold prices depressed -- which, then, keeps inflation low -- which, in their minds, could serve to validate their reasons for maintaining low interest rates and/or some form(s) of Quantitative Easing -- perpetuating this never-ending cycle of low economic growth, in which we seem to be stuck and, which, world governments seem to be incapable of, or unwilling to, address.

The question, then, becomes how much could markets advance next year, if a major international incident did not occur? Possibly around 5-6% -- a bit higher than this year's increase, which peaked (as of today's writing of this article...December 7th) at its (daily closing) high of 3.49% on May 21st -- in a potential run-up to the U.S. presidential election to be held on November 8th.

In that case, I'd keep an eye on the Technology Sector and Cyclicals to continue to outperform other sectors in the U.S. and to see if the Financials Sector begins to, substantially, firm up, along with the Industrials Sector. Otherwise, we may only see a repeat of 2015 and achieve around a 4% increase, or less, for 2016. Here's how they've performed, so far this year, as shown on the following Year-to-Date graph of the 9 Major Sectors...

Regarding the Financials Sector, the following three Daily ratio charts are worth noting...they show the strength/weakness of the:

- XLF (U.S. Financials ETF) compared to $SPX

- EUFN (European Financials ETF) compared to $STOX50

- GXC (Chinese Financials ETF) compared to $SSEC

Each chart shows that price is trading at or near major price resistance and their converging 50 and 200 MAs, and that all of these financial sectors are currently weaker than their country's counterpart Major Index...the last two at a considerable discount. Unless we see all three of these firm up and outpace their major indices, I doubt we'll see that 5-6% potential target increase achieved in U.S. equities.

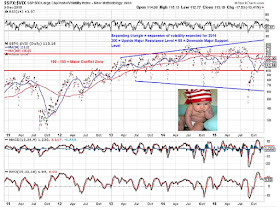

In any event, as mentioned in my post of December 3rd, I'll re-iterate that, "I think 2016 will see greater volatility and much larger swings than we've seen this year." My comments and chart contained therein still apply (and are worth monitoring, along with the above charts and graph, over the coming weeks and months) regarding major resistance and support levels on the SPX:VIX ratio and equity market follow-through.