I last mentioned the spread between Brent Crude Oil and WTIC Light Crude Oil in this post on May 5th, 2013. At that time, price had narrowed considerably between these two.

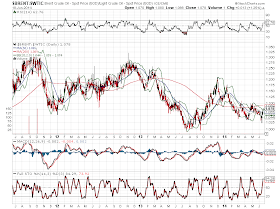

The following 3-Year Daily ratio chart of BRENT:WTIC shows that the spread has been widening recently in favour of Brent. With the positive cross of the RSI above 50 and the positive cross-overs of the MACD and Stochastics, it would appear that this spread may continue to widen...if price can break and hold above the 50 and, possibly, 200 MAs.

The following 3-Year Daily chart of Brent shows that major resistance lies higher than current price at 117.00-119.00.

The following 3-Year Daily chart of WTIC shows that major resistance awaits at around 112.00.

With RSIs in their upper range on both of these two charts, we may see some profit-taking sometime soon...however, the RSIs aren't signalling any divergence, nor is momentum (which is above the zero level on both)...and, both are under the bullish influence of recent Golden Cross formations. The only divergence is the Stochastics on WTIC, with a negative cross-over, as well. We'll see whether the recent climb in both Brent and WTIC continues and whether the spread widens further in favour of Brent.