Further to my post of May 8th, we can see from the following Monthly, Weekly, Daily, and 60-minute charts of the SPX:VIX ratio, that the bulls are pushing the SPX to the limit, in terms of major resistance on the price ratio, as well as the Momentum indicator.

In spite of the new price-ratio high reached today (Wednesday), momentum has yet to confirm any bullish breakout on all four timeframes...one to watch closely over the next few days. In any event, any breakout may be short-lived, in order to relieve an overbought situation at historically high levels in momentum.

Pages

▼

Thursday, May 22, 2014

Saturday, May 17, 2014

Small Caps in the Midst of Turbulence

The following Year-to-date percentage gained/lost graph of the Major Indices shows that the Small Cap Index (Russell 2000) has dropped by 5.22% since January 1st of this year...a significant variance from the others.

The next percentage gained lost graph of these indices shows that Small Caps continued their weakness in last week's trading.

The 5-Year Weekly chart below of the Russell 2000 e-mini futures index (TF), shows price sitting on the 50 week moving average. The weekly Volume Profile along the right side of the chart shows that price rallied last year on thinner-than-average volumes down to the POC level at 827, as does the volume histogram overlayed along the bottom of the chart. Momentum has been accelerating to the downside, as have the Stochastics and RSI.

The following 1-Year Daily chart of the TF shows that price is sitting at major price support and below the 200 daily moving average, as well as the POC of the daily Volume Profile at 1116. All 3 technical indicators are still in negative territory, with no reversals to the upside yet. Volumes are thin below current price down to the 980 level, as shown on the Volume Profile.

The following 180-day 1-hour chart of the TF shows a closer look look at price support around the 1080 level, with price below the declining 50 and 200 hour moving averages and the monthly VWAP, as well as the hourly Volume Profile POC at 1116.

I would suggest that a failure to rally and hold above 1116 may lead to continued weakness in Small Caps, which could drag down the other Major Indices, particularly if Technology takes a turn for the worse...two markets to keep a eye on over the coming weeks.

Have a great weekend and best of luck next week...the Canadian markets are closed on Monday for the Victoria Day holiday.

The next percentage gained lost graph of these indices shows that Small Caps continued their weakness in last week's trading.

The 5-Year Weekly chart below of the Russell 2000 e-mini futures index (TF), shows price sitting on the 50 week moving average. The weekly Volume Profile along the right side of the chart shows that price rallied last year on thinner-than-average volumes down to the POC level at 827, as does the volume histogram overlayed along the bottom of the chart. Momentum has been accelerating to the downside, as have the Stochastics and RSI.

The following 1-Year Daily chart of the TF shows that price is sitting at major price support and below the 200 daily moving average, as well as the POC of the daily Volume Profile at 1116. All 3 technical indicators are still in negative territory, with no reversals to the upside yet. Volumes are thin below current price down to the 980 level, as shown on the Volume Profile.

The following 180-day 1-hour chart of the TF shows a closer look look at price support around the 1080 level, with price below the declining 50 and 200 hour moving averages and the monthly VWAP, as well as the hourly Volume Profile POC at 1116.

I would suggest that a failure to rally and hold above 1116 may lead to continued weakness in Small Caps, which could drag down the other Major Indices, particularly if Technology takes a turn for the worse...two markets to keep a eye on over the coming weeks.

Have a great weekend and best of luck next week...the Canadian markets are closed on Monday for the Victoria Day holiday.

Thursday, May 15, 2014

Weakness in European Financials ETF (EUFN)

Recent weakness in the European Financials ETF (EUFN) was punctuated by today's (Thursday's) gap down and close below the 50 day MA, as shown on the following 1-year Daily chart.

All 3 technical indicators have also dropped below their respective mid-point...signalling potential further weakness ahead. Major support sits around 23.50 to 24.50. Failure (drop and hold) below 23.50 could spark a major sell-off in European stocks...one to watch in the weeks ahead...particularly as the next ECB meeting approaches on June 5th.

All 3 technical indicators have also dropped below their respective mid-point...signalling potential further weakness ahead. Major support sits around 23.50 to 24.50. Failure (drop and hold) below 23.50 could spark a major sell-off in European stocks...one to watch in the weeks ahead...particularly as the next ECB meeting approaches on June 5th.

Wednesday, May 14, 2014

SPX vs Major Sectors: Stock Market Weakness Ahead?

The following 11 1-Year Daily charts show the 9 Major Sectors, plus Housing and Biotech.

You can see that Technology (XLK), Industrials (XLI), Materials (XLB), Energy (XLE), and Consumer Staples (XLP) have been the strongest performers, of late. The laggards have been Housing (XHB) and Biotech (IBB)

The next 11 1-Year Daily ratio charts show the relative strength/weakness of each of these sectors compared with the SPX.

What I notice immediately on these is the relative weakness of Cyclicals (XLY), Financials (XLF), and Housing (XHB), followed by Biotech (IBB). Unless we see a firming up and buying begin in these 4 sectors, we may see a general weakness creep into the stock market, in general...ones worth watching going forward.

The accumulation we've seen in 2-5-10-30-year bonds of late, and particularly today (Wednesday), may be an attempt by the institutions/market makers to lower interest rates as a precursor to, potentially, stimulate buying in these sectors...so, bonds/rates are also worth tracking over the next weeks/months, relative to these and all sectors...see Sectors vs 30-year bond ratio charts at this link and on the last set of 1-Year Daily ratio charts below.

You can see that Technology (XLK), Industrials (XLI), Materials (XLB), Energy (XLE), and Consumer Staples (XLP) have been the strongest performers, of late. The laggards have been Housing (XHB) and Biotech (IBB)

The next 11 1-Year Daily ratio charts show the relative strength/weakness of each of these sectors compared with the SPX.

What I notice immediately on these is the relative weakness of Cyclicals (XLY), Financials (XLF), and Housing (XHB), followed by Biotech (IBB). Unless we see a firming up and buying begin in these 4 sectors, we may see a general weakness creep into the stock market, in general...ones worth watching going forward.

The accumulation we've seen in 2-5-10-30-year bonds of late, and particularly today (Wednesday), may be an attempt by the institutions/market makers to lower interest rates as a precursor to, potentially, stimulate buying in these sectors...so, bonds/rates are also worth tracking over the next weeks/months, relative to these and all sectors...see Sectors vs 30-year bond ratio charts at this link and on the last set of 1-Year Daily ratio charts below.

Monday, May 12, 2014

Russian vs German Indices

The following 3-year Daily Ratio chart of the Russian Index vs. the German Index shows a very recent bounce in favour of Russia, following a 3 year relative decline in Russia's strength in the markets. All three technical indicators have now been pulled into positive territory (above their mid-points), and price has bounced above the declining 50 day moving average. Major resistance sits around the declining 200 day moving average.

I'd watch to see if these levels are held in the days/weeks ahead as a possible gauge of any easing of tensions between these two countries and softening of sanctions against Russia over the Ukraine situation...resulting in a strengthening of the Russian markets. Otherwise, a drop and hold below the March lows could spell bigger political unrest and trouble ahead.

In any event, there is room for some large and volatile price swings in between the 200 day moving average and the March lows until a clean break and hold is made either above or below those levels. Such movements may tie in with any volatile movements that may occur in the U.S. markets, as I described in my last post.

I'd watch to see if these levels are held in the days/weeks ahead as a possible gauge of any easing of tensions between these two countries and softening of sanctions against Russia over the Ukraine situation...resulting in a strengthening of the Russian markets. Otherwise, a drop and hold below the March lows could spell bigger political unrest and trouble ahead.

In any event, there is room for some large and volatile price swings in between the 200 day moving average and the March lows until a clean break and hold is made either above or below those levels. Such movements may tie in with any volatile movements that may occur in the U.S. markets, as I described in my last post.

Sunday, May 11, 2014

Saturday, May 10, 2014

SPX vs Major World Indices, Commodities & Bonds

The following 3-year Daily ratio charts compare the price action, strength/weakness, and current price level of the SPX with a number of major world indices, commodities, and 30-year bonds.

You can see, at a glance, that the SPX has been weaker than most of the other major world indices, of late (other than China, Japan, and, to some extent, Australia), and price sits at or near to major support. On the other hand, the SPX has been stronger recently than the NDX and the RUT, as well as Gold, Silver, Copper and Oil. The SPX vs the World Index is slightly weaker, and price sits at major support. The SPX has been stronger than 30-year bonds, but is sitting in between major support and resistance in a neutral zone.

The big question is, "Will we see buyers step back into the SPX in the near term?" If so, we'd see price enter into the "froth area" that I wrote about in an earlier post on April 5th. Additionally, we would see price rise above historically high levels on the SPX:VIX ratio chart that I wrote about in my last post on May 8th.

If buyers are willing to take on more risk while the Fed holds interest rates low, we may see them step back into the SPX, NDX, RUT, China, Japan, and Australia, and, possibly, step out of some European and BRIC country holdings, commodities, and 30-year bonds. If not, we may see prices rise in commodities and 30-year bonds, as I wrote about in my post of May 2nd. Otherwise, we may continue to see an increasingly volatile game of leapfrog rotation and large swings play out amongst these markets over the next weeks/months...buckle up...it could be a wild ride!

You can see, at a glance, that the SPX has been weaker than most of the other major world indices, of late (other than China, Japan, and, to some extent, Australia), and price sits at or near to major support. On the other hand, the SPX has been stronger recently than the NDX and the RUT, as well as Gold, Silver, Copper and Oil. The SPX vs the World Index is slightly weaker, and price sits at major support. The SPX has been stronger than 30-year bonds, but is sitting in between major support and resistance in a neutral zone.

The big question is, "Will we see buyers step back into the SPX in the near term?" If so, we'd see price enter into the "froth area" that I wrote about in an earlier post on April 5th. Additionally, we would see price rise above historically high levels on the SPX:VIX ratio chart that I wrote about in my last post on May 8th.

If buyers are willing to take on more risk while the Fed holds interest rates low, we may see them step back into the SPX, NDX, RUT, China, Japan, and Australia, and, possibly, step out of some European and BRIC country holdings, commodities, and 30-year bonds. If not, we may see prices rise in commodities and 30-year bonds, as I wrote about in my post of May 2nd. Otherwise, we may continue to see an increasingly volatile game of leapfrog rotation and large swings play out amongst these markets over the next weeks/months...buckle up...it could be a wild ride!

Thursday, May 08, 2014

Cherry Picking in the SPX:VIX Ratio

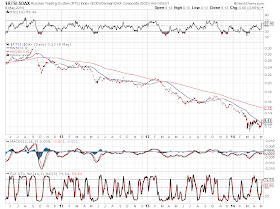

There is lots of cherry picking going on at these upper levels of the following 20-year monthly SPX:VIX ratio chart.

Unless we see price climb and hold above the 150 major resistance level and the Momentum indicator begin to break and hold above its current downward sloping trend and rise above historically high levels, we may see further downside and volatility enter the SPX...if not immediately, then, possibly sometime soon.

Unless we see price climb and hold above the 150 major resistance level and the Momentum indicator begin to break and hold above its current downward sloping trend and rise above historically high levels, we may see further downside and volatility enter the SPX...if not immediately, then, possibly sometime soon.

Friday, May 02, 2014

Leaders & Laggards - U.S. Major Indices & Sectors, World Indices, Commodities, Forex, and Social Media Stocks

The following 1-year Daily charts are simply presented to show trend, support and resistance levels, and current price levels for the past year for a variety of U.S. Major Indices & Sectors, World Indices, Commodities, Forex pairs, and U.S. social media ETF & stocks.

The accompanying 1-year percentage-gained graphs show the leaders and laggards for those groups.

Dow Transports and Nasdaq Transports are the clear leaders based on price performance and percentage gained over a one-year period, while Dow Utilities lags on percentage gained during that same period (even though it has outperformed in 2014). The Nasdaq 100 and Russell 2000 Indices are the ones to watch to see if recent weakness persists...if so, they may negatively influence and drag down the others. However, if we see the Dow and the S&P 500 begin to rally and hold above their near-term resistance levels, and if the Nasdaq and Russell still decline, it may simply mean a rotation out of risk and into value sectors and stocks. Looking at the percentage-gained graphs on a weekly basis will reveal the short-term trend.

Although Biotech is not one of the 9 Major Sectors, I've included it to illustrate that it's leading, along with Industrials, while Utilities lags in terms of percentage gained (notwithstanding its relative outperformance in 2014). I'd keep an eye on Energy, Consumer Staples, and Utilities to see if they maintain recent upward momentum.

Greece is the leader on a one-year percentage-gained basis (notwithstanding its weakness in 2014), while France is the laggard. Europe is mixed and its near-term performance may be tied in with the situation in the Ukraine...we may see hints of direction for these within the Energy and Commodities groups.

The Emerging Markets ETF is flat, while India is the leader on a percentage-gained basis. Russia is the laggard...it bounced in March after setting a 3-year low and is caught in recent chop just below major (3 year) resistance...we'll see what happens in the Ukraine and how it affects this index. China is also a major laggard and is sitting at major (3 year) support...one to watch, along with the Aussie $ and Copper.

Canada's TSX Index is the leader, while Japan, London, and Australia are, essentially, tied, on a percentage-gained basis for the past year. Further strength in Energy and Commodities may continue to support price in Toronto's Index.

The Agricultural ETF (DBA) has gained the most, while Silver has lost the most on a percentage basis. As I mentioned in my post of May 2nd, Gold, Silver, Copper and DBC are at major support levels and may be poised for a hard rally.

The British Pound has gained the most, while the Aussie Dollar has lost the most. The U.S. Dollar is sitting at/above major (3 year) support and may also be poised for a hard rally, as may 30-Year Bonds, which is now sitting just above major (3 year) resistance (as shown in the above chart grouping).

Facebook is the leader, while BlackBerry has lost the most. Twitter, is below its IPO price. Further weakness in the Social Media group may, ultimately, drag Facebook down; however, the others are sitting at/near major support, so we'll see if traders start accumulating positions in those stocks and ETF.

Have a great weekend and best of luck next week!

The accompanying 1-year percentage-gained graphs show the leaders and laggards for those groups.

Major U.S. Indices

Dow Transports and Nasdaq Transports are the clear leaders based on price performance and percentage gained over a one-year period, while Dow Utilities lags on percentage gained during that same period (even though it has outperformed in 2014). The Nasdaq 100 and Russell 2000 Indices are the ones to watch to see if recent weakness persists...if so, they may negatively influence and drag down the others. However, if we see the Dow and the S&P 500 begin to rally and hold above their near-term resistance levels, and if the Nasdaq and Russell still decline, it may simply mean a rotation out of risk and into value sectors and stocks. Looking at the percentage-gained graphs on a weekly basis will reveal the short-term trend.

U.S. Sectors

Although Biotech is not one of the 9 Major Sectors, I've included it to illustrate that it's leading, along with Industrials, while Utilities lags in terms of percentage gained (notwithstanding its relative outperformance in 2014). I'd keep an eye on Energy, Consumer Staples, and Utilities to see if they maintain recent upward momentum.

Germany, France & PIIGS Countries

Greece is the leader on a one-year percentage-gained basis (notwithstanding its weakness in 2014), while France is the laggard. Europe is mixed and its near-term performance may be tied in with the situation in the Ukraine...we may see hints of direction for these within the Energy and Commodities groups.

Emerging Markets ETF & BRIC Countries

The Emerging Markets ETF is flat, while India is the leader on a percentage-gained basis. Russia is the laggard...it bounced in March after setting a 3-year low and is caught in recent chop just below major (3 year) resistance...we'll see what happens in the Ukraine and how it affects this index. China is also a major laggard and is sitting at major (3 year) support...one to watch, along with the Aussie $ and Copper.

Toronto, Japan, London, Australia & World Market Indices

Canada's TSX Index is the leader, while Japan, London, and Australia are, essentially, tied, on a percentage-gained basis for the past year. Further strength in Energy and Commodities may continue to support price in Toronto's Index.

Commodities, US $ & US Bonds

The Agricultural ETF (DBA) has gained the most, while Silver has lost the most on a percentage basis. As I mentioned in my post of May 2nd, Gold, Silver, Copper and DBC are at major support levels and may be poised for a hard rally.

Forex Pairs

The British Pound has gained the most, while the Aussie Dollar has lost the most. The U.S. Dollar is sitting at/above major (3 year) support and may also be poised for a hard rally, as may 30-Year Bonds, which is now sitting just above major (3 year) resistance (as shown in the above chart grouping).

U.S. Social Media ETF & Stocks

Facebook is the leader, while BlackBerry has lost the most. Twitter, is below its IPO price. Further weakness in the Social Media group may, ultimately, drag Facebook down; however, the others are sitting at/near major support, so we'll see if traders start accumulating positions in those stocks and ETF.

Have a great weekend and best of luck next week!

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)