This will be my last post...I've stopped trading (after 10 years at this game) and blogging (for a number of personal reasons).

However, I'll leave my Blog up (at least for awhile) since it contains a lot of useful reference material.

I'd like to thank all who've visited my Blog over the past couple of years and those who've kindly e-mailed me. And, I wish to give a hearty 'thank-you' to all websites that are either linked to my Blog or have published my articles...the creators of these sites have been most generous and I'm very grateful for the exposure. :-)

Take care and best of luck to all.

Cheers,

SB

Pages

▼

Wednesday, July 17, 2013

Monday, July 15, 2013

Relative Strength of 10 Major World Indices

The following Daily charts show price action for 1 year on the SPX and other select major world indices. I've chosen these simply to illustrate comparative market strength of these regions.

If you look at price action from the beginning of 2013, you can see that Japan's Nikkei has gained the most, followed by the SPX, London's FTSE, Germany's DAX, France's CAC, and Australia's AORD. The laggards have been the BRIC countries, although India is slightly in the green for the year. This is more easily seen on the following Year-to-date percentage gained/lost graph.

This news has just been released regarding the ECB's EFSF (I've written about the EFSF and the OMT here relative to the OMT's legitimacy):

Any substantial weakening of the EU countries (particularly below the 50 MA) in response to this news could have a negative affect on the SPX, as well as the already-depressed BRIC countries...ones to watch over the days/weeks to come.

If you look at price action from the beginning of 2013, you can see that Japan's Nikkei has gained the most, followed by the SPX, London's FTSE, Germany's DAX, France's CAC, and Australia's AORD. The laggards have been the BRIC countries, although India is slightly in the green for the year. This is more easily seen on the following Year-to-date percentage gained/lost graph.

This news has just been released regarding the ECB's EFSF (I've written about the EFSF and the OMT here relative to the OMT's legitimacy):

Any substantial weakening of the EU countries (particularly below the 50 MA) in response to this news could have a negative affect on the SPX, as well as the already-depressed BRIC countries...ones to watch over the days/weeks to come.

Friday, July 12, 2013

Money Flow for July Week 2

Further to my last Weekly Market Update, this week's update will look at:

- 6 Major Indices

- 9 Major Sectors

- YM, ES, NQ, TF, & NKD

- Comparison of SPX, TNX, Oil, Gasoline, DJUSFD, XLF, GE, XHB, Lumber & Copper

- Percentage of Stocks Above 20-50-200-Day Moving Averages

- Comparison of NDX, SPX, VIX & VXN (Is Bubble No. 3 about to burst?)

6 Major Indices

As shown on the Weekly charts and the percentage gained/lost graph below of the Major Indices, the Dow Utilities gained the most, followed by the Nasdaq 100, Russell 2000, S&P 500, Dow Transports, and Dow 30 this past week.

9 Major Sectors

As shown on the Weekly charts and the percentage gained/lost graph of the Major Sectors, the largest gains were made in Utilities, followed by Consumer Staples, Health Care, Materials, Cyclicals, Financials, Industrials, Energy, and Technology.

It was a "risk-on" week, but slightly favouring the Defensive sectors.

YM, ES, NQ, TF & NKD

As I mentioned in my last weekly market update, I was looking for any advance above the middle of an uptrending channel from the November 2012 lows to occur on higher volumes.

You can see from the Weekly charts below that this week's advance (along with the prior week) occurred on lower volumes. While the YM, ES, NQ & TF are now above the middle of their respective channels, I'd like to see higher volumes take any further move higher. However, if the major moves continue to occur on overnight low volumes, we may not see higher weekly volumes appear.

Since the NQ & TF are nearing the top of their channels, we may see any further upside momentum slow down soon and profit-taking begin to occur.

Japan's Nikkei is lagging...whether it recovers to its prior highs remains to be seen.

Comparison of SPX, TNX, Oil, Gasoline, DJUSFD, XLF, GE, XHB, Lumber & Copper

I first introduced this grouping in my last weekly market update in order to compare any further rise in Treasury yields with consumer products and services.

As shown on the following Daily charts and the percentage gained/lost graph of this group, you can see that while the 10-Year yields dropped over the past week, gains were made in the rest, with Homebuilders gaining the most, followed by Gasoline, Food Retailers/Wholesalers, Lumber, S&P 500, Financials, Copper, Oil, and GE.

Risk was added as yields dropped...we'll see if that continues, or what happens to these instruments if yields begin to climb again.

Also worth watching in the days/weeks going forward is the JNK:TNX ratio, as I last discussed on July 10th as a gauge of risk-appetite in the face of rising treasury yields.

Percentage of Stocks Above 20-50-200-Day Moving Averages

The following 5-Year Daily charts of the percentage of stocks above 20-50-200-day moving averages show that, in the short term, stocks above their 20-day MA are at a major resistance level. As such, and co-incidental with my comments above related to the NQ & TF, we may see profit-taking occur soon.

In the medium term, stocks above their 50-day MA still have a short distance to travel before they are at major resistance.

In the longer term, stocks above their 200-day MA are nearing their major resistance level.

Comparison of SPX, NDX, VIX & VXN

I wrote about the potential for another technology bubble brewing on October 16, 2012. I mentioned that there had been two bubbles followed by swift and deep declines from 2000. Shortly after my post, the NDX pulled back somewhat, but has resumed its climb and now sits at a former resistance level established in 2000 before it continued its meteoric plunge from Bubble No. 1 to the 2002 lows.

The SPX is just above its second bubble's resistance level.

The spread between the NDX and the SPX continues to widen. We'll see how long Technology continues its climb this time before succumbing to the "Laws of Gravity" (and the "Laws of Bubbles").

Next week, we'll see the release of the Beige Book report on Wednesday and the expiration of monthly options on Friday. As well, Ben Bernanke testifies before the House Financial Services Committee on Wednesday and before the Senate Banking Committee on Thursday. As such, we may see more overnight and intraday larger swings and volatility enter the markets. Furthermore, we may see more volatile swings in the Shanghai Index and the Aussie $, as I wrote about on July 11th, as traders react to a whole slew of economic data to be released on Sunday, Monday, and Tuesday concerning China. Any further weakness in Japan's Nikkei may have a negative impact on the Shanghai Index and the Aussie $, or vice versa. Furthermore, traders may position themselves (in anticipation of any major policy decisions) ahead of the G20 meetings, which take place on Friday and Saturday. It should be an "interesting" week.

Have a great weekend and good luck next week.

Thursday, July 11, 2013

China's Shanghai Index and AUD/CAD

I last wrote about the importance of China's Shanghai Index regaining control and remaining above the 2000 level on June 24th.

Since then, price has rallied and has closed above 2000 in Thursday's action, as shown on the Daily chart below. The next hurdle will be to rally and hold above the 50 and 200 MAs at 2200, followed by a downtrend line at 2300.

One gauge of China's strength going forward may be exemplified by the AUD/CAD forex pair.

You can see from the following Weekly chart that, as of Thursday evening, price has, once again, broken below the lower edge of the downtrending channel and is threatening to fall to the next support level of 0.9300, or lower.

Further weakness in AUD/CAD may drag the Shanghai Index back below the critical 2000 level (or vice versa)...worthwhile watching if you trade the Shanghai market.

Since then, price has rallied and has closed above 2000 in Thursday's action, as shown on the Daily chart below. The next hurdle will be to rally and hold above the 50 and 200 MAs at 2200, followed by a downtrend line at 2300.

One gauge of China's strength going forward may be exemplified by the AUD/CAD forex pair.

You can see from the following Weekly chart that, as of Thursday evening, price has, once again, broken below the lower edge of the downtrending channel and is threatening to fall to the next support level of 0.9300, or lower.

Further weakness in AUD/CAD may drag the Shanghai Index back below the critical 2000 level (or vice versa)...worthwhile watching if you trade the Shanghai market.

Wednesday, July 10, 2013

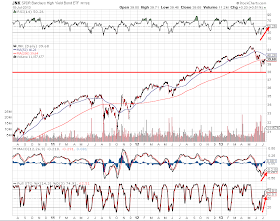

JNK:TNX Ratio -- Will Traders Buy JNK in Spite of Rising Interest Rates?

JNK:TNX Daily ratio -- price flirting with major triple bottom support...some positive divergence on all 3 indicators...hinting that JNK will attract buyers in spite of rising interest rates: 3-Year Daily chart of JNK:TNX

JNK attempts to stabilize at 200 Day MA...will see if traders buy into corporate bonds once more...frothy volumes kept price from plunging after initial drop below 200 MA...all 3 indicators pointing to a higher price...if so, equities should continue to rise, in general, but will see how JNK performs against TNX in the coming days/weeks: 3-Year Daily chart of JNK

TNX approaching major resistance level on slightly negative divergence on indicators...hinting at pause or slow-down in rate rise: 3-Year Daily chart of TNX

JNK attempts to stabilize at 200 Day MA...will see if traders buy into corporate bonds once more...frothy volumes kept price from plunging after initial drop below 200 MA...all 3 indicators pointing to a higher price...if so, equities should continue to rise, in general, but will see how JNK performs against TNX in the coming days/weeks: 3-Year Daily chart of JNK

TNX approaching major resistance level on slightly negative divergence on indicators...hinting at pause or slow-down in rate rise: 3-Year Daily chart of TNX

Sunday, July 07, 2013

Celebratory Post No. 1001

A good reason to celebrate passing my 1000-post milestone with this little tidbit (since I'm partly Scottish)...

A good reason to celebrate passing my 1000-post milestone with this little tidbit (since I'm partly Scottish)...

Congratulations, Andy Murray, for your 2013 Wimbledon win!

Friday, July 05, 2013

Money Flow for July Week 1

Further to my last Weekly Market Update, this week's update will look at:

6 Major Indices

9 Major Sectors

YM, ES, NQ, TF & NKD

I most recently discussed the price action from the November 2012 lows on these 5 E-mini Futures Indices in my last weekly market update.

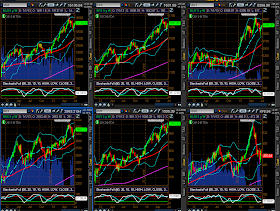

You can see from the updated Weekly charts below that Small-caps (TF) and Technology (NQ) garnered the most support during the week to close just above the middle of their respective uptrending channels. The TF has made a new Daily swing high but will need to make a higher swing low to, potentially, re-establish its former uptrend on the daily timeframe...the one to watch for either continued leadership in a push higher, or for the onset of weakness to, potentially, drag the others lower.

I'd be looking for all of these indices to advance and hold above their mid-channel levels to signal that the bulls have control, once again, and are ready to take these markets higher...BUT I'd like to see any further advance beyond that level done so on higher volumes...otherwise, we may just be witnessing a "dead cat bounce" that has no sustainability. This week's advance occurred on greatly-reduced volumes, likely due to the July 3rd & 4th holiday closures.

As such, we may see this past week's lows tested, and possibly the prior week's lows, before a serious advance resumes.

Comparison of SPX, TNX, Oil, Gasoline, DJUSFD, XLF, GE, XHB, Lumer, Copper

Inasmuch as 2013 Q2 earnings season begins next week with Alcoa reporting on Monday, I thought it might be interesting to monitor the following Indices and Sectors during Q3.

In the "real world" where the "ninety-nine-percenters" are affected the most by inflationary factors, I've assembled the following grouping to see how the SPX reacts to any further rise in the other instruments. It's my opinion that it's unfair and misleading to simply look at one segment of the market and say that a further rise in prices or interest/loan rates would not be onerous on consumers; rather, it's important to look at the impact on the average consumer based on aggregate factors.

You can see from the following 1-Year Daily charts and 1-Year percentage gained/lost graph that 10-Year Treasury yields have gained the most (a whopping 70.01%) during this timeperiod and have set a new 1-year high on Friday, while the Homebuilders Sector is up by 35.57% and is in the midst of a recent downtrend after making a new 1-year high, the Food Retailers & Wholesalers Index is up by 20.08% and is near its 1-year highs, Oil is up by 18.63% and is at a new 1-year high, and Gasoline is up by 5.54% and is retesting recent resistance above the 50 MA. Furthermore, Lumber is now up 8.77% after retesting support near its 1-year lows and Copper is in the red, but is retesting support near its 1-year lows. As well, the Financials Sector has gained 38.29% and is trading near 1-year highs.

I don't know about the rest of you, but my grocery and gasoline bills have been steadily increasing over the past year, and my home and car insurance is more expensive this year than last (I'm definitely not in the 1% category). Further increases in bank loan rates, car loan rates, mortgage rates, home prices, rents, various insurance products, gasoline prices, food, and the cost of cyclical products (as represented by GE, which is up 18.13% and trading near 1-year highs) are bound to place a definite "drag" on consumers...AND I haven't even touched on rising costs associated with health care, education, numerous services, municipal/state/federal taxes, entertainment, travel, etc.

Any further hike in Treasury yields will, no doubt, affect all consumer products and services...at some point, we'll see a slowing in consumer demand...AND I doubt whether any further improvements in job creation in the near term will be sufficient to eliminate and overcome such a cumulative affect in costs, particularly if they continue to be skewed to part-time rather than full-time hiring, as seems to be favoured at the moment. (You can find the latest employment report at this link and 3 summary tables here, here and here...links to other summaries may be found at the bottom of the first link.) That's why I'm monitoring this group for any signs of weakness or excessive frothiness during Q3 and Q4 [in spite of what Q2 earnings reports (and any forward-guidance) may reveal] to gauge the impact on the SPX.

- 6 Major Indices

- 9 Major Sectors

- YM, ES, NQ, TF & NKD

- Comparison of SPX, TNX, Oil, Gasoline, DJUSFD, XLF, GE, XHB, Lumber, Copper

As shown on the Weekly charts and the percentage gained/lost graph below of the Major Indices, the Russell 2000 gained the most, followed by the Dow Transports, Nasdaq 100, S&P 500, and Dow 30, while losses were made in the Dow Utilities this past week.

As shown on the Weekly charts and the percentage gained/lost graph of the Major Sectors, the largest gains were made in Cyclicals, followed by Energy, Technology, Financials, Industrials, Health Care, Materials, and Consumer Staples, while there were losses in Utilities.

YM, ES, NQ, TF & NKD

I most recently discussed the price action from the November 2012 lows on these 5 E-mini Futures Indices in my last weekly market update.

You can see from the updated Weekly charts below that Small-caps (TF) and Technology (NQ) garnered the most support during the week to close just above the middle of their respective uptrending channels. The TF has made a new Daily swing high but will need to make a higher swing low to, potentially, re-establish its former uptrend on the daily timeframe...the one to watch for either continued leadership in a push higher, or for the onset of weakness to, potentially, drag the others lower.

I'd be looking for all of these indices to advance and hold above their mid-channel levels to signal that the bulls have control, once again, and are ready to take these markets higher...BUT I'd like to see any further advance beyond that level done so on higher volumes...otherwise, we may just be witnessing a "dead cat bounce" that has no sustainability. This week's advance occurred on greatly-reduced volumes, likely due to the July 3rd & 4th holiday closures.

As such, we may see this past week's lows tested, and possibly the prior week's lows, before a serious advance resumes.

Comparison of SPX, TNX, Oil, Gasoline, DJUSFD, XLF, GE, XHB, Lumer, Copper

Inasmuch as 2013 Q2 earnings season begins next week with Alcoa reporting on Monday, I thought it might be interesting to monitor the following Indices and Sectors during Q3.

In the "real world" where the "ninety-nine-percenters" are affected the most by inflationary factors, I've assembled the following grouping to see how the SPX reacts to any further rise in the other instruments. It's my opinion that it's unfair and misleading to simply look at one segment of the market and say that a further rise in prices or interest/loan rates would not be onerous on consumers; rather, it's important to look at the impact on the average consumer based on aggregate factors.

You can see from the following 1-Year Daily charts and 1-Year percentage gained/lost graph that 10-Year Treasury yields have gained the most (a whopping 70.01%) during this timeperiod and have set a new 1-year high on Friday, while the Homebuilders Sector is up by 35.57% and is in the midst of a recent downtrend after making a new 1-year high, the Food Retailers & Wholesalers Index is up by 20.08% and is near its 1-year highs, Oil is up by 18.63% and is at a new 1-year high, and Gasoline is up by 5.54% and is retesting recent resistance above the 50 MA. Furthermore, Lumber is now up 8.77% after retesting support near its 1-year lows and Copper is in the red, but is retesting support near its 1-year lows. As well, the Financials Sector has gained 38.29% and is trading near 1-year highs.

I don't know about the rest of you, but my grocery and gasoline bills have been steadily increasing over the past year, and my home and car insurance is more expensive this year than last (I'm definitely not in the 1% category). Further increases in bank loan rates, car loan rates, mortgage rates, home prices, rents, various insurance products, gasoline prices, food, and the cost of cyclical products (as represented by GE, which is up 18.13% and trading near 1-year highs) are bound to place a definite "drag" on consumers...AND I haven't even touched on rising costs associated with health care, education, numerous services, municipal/state/federal taxes, entertainment, travel, etc.

Any further hike in Treasury yields will, no doubt, affect all consumer products and services...at some point, we'll see a slowing in consumer demand...AND I doubt whether any further improvements in job creation in the near term will be sufficient to eliminate and overcome such a cumulative affect in costs, particularly if they continue to be skewed to part-time rather than full-time hiring, as seems to be favoured at the moment. (You can find the latest employment report at this link and 3 summary tables here, here and here...links to other summaries may be found at the bottom of the first link.) That's why I'm monitoring this group for any signs of weakness or excessive frothiness during Q3 and Q4 [in spite of what Q2 earnings reports (and any forward-guidance) may reveal] to gauge the impact on the SPX.

We'll see the release of the minutes of the last FOMC meeting on Wednesday at 2:00pm EDT. No doubt, analysts will be scrutinizing the language related to any future Fed bond purchase "tapering."

Have a great weekend, stay cool, and good luck next week.

TNX:SPX Ratio

I last wrote about the TNX:SPX ratio here.

We'll see how long equity markets (SPX) continue to "embrace" rising 10-year treasury yields (TNX)...watching this TNX:SPX ratio for a clear break and hold above the last pivot high to signal continued strength in yields vs. equities.

We'll see how long equity markets (SPX) continue to "embrace" rising 10-year treasury yields (TNX)...watching this TNX:SPX ratio for a clear break and hold above the last pivot high to signal continued strength in yields vs. equities.