- 6 Major Indices

- 9 Major Sectors

- VIX and SPX:VIX Ratio

- RUT:RVX Ratio

- Advance/Decline Issues Index

- Number of Stocks Above 20-50-200-Day Moving Averages

- NYSI Summation Index

- 30-Year Bonds

- U.S. $

- China's Shanghai Index

6 Major Indices

As shown on the Weekly charts and 1-Week percentage gained/lost graph below of the Major Indices, gains were made in the Dow Utilities, while the Nasdaq 100, Russell 2000, and S&P 500 experienced varying degrees of loss. The Dow 30 and Dow Transports were, essentially, flat on the week.

9 Major Sectors

As shown on the Weekly charts and 1-Week percentage gained/lost graph below of the Major Sectors, the largest gains were made in Consumer Staples, followed by Utilities. The largest losses were made in Materials, followed by Cyclicals, Energy, Industrials, and Technology. Health Care and Financials were flat overall.

VIX and SPX:VIX Ratio

There was a slight increase in volatility, which abated somewhat by Friday's close, as shown on the Daily chart of the VIX.

I wrote on Thursday that a break and hold below 95.00 on the Weekly SPX:VIX ratio chart and the zero level on the Momentum indicator could indicate that a big decline is in store for the SPX.

As you can see on this updated chart below, the SPX bounced into Friday's close. 95.00 is still holding as major support, along with the zero level on Momentum, so Thursday's comments are still valid.

RUT:RVX Ratio

I also wrote on Thursday that a break and hold below 50.00 on the Weekly RUT:RVX ratio chart and the zero level on the Momentum indicator could indicate that a big decline is in store for the RUT.

As you can see on this updated chart below, the RUT also bounced into Friday's close. 50.00 is still holding as major support, along with the zero level on Momentum, so Thursday's comments are still valid.

Furthermore, price on the Russell 2000 e-mini Futures Index (TF) also held (for the most part) and closed above the 900.00 level, as shown on the updated 60 min (market hours only) chart below. As I said on Thursday, a break and hold below 900.00 could signal much more weakness to come, depending on whether we see increasing volumes on the decline.

I would, however, draw your attention to Friday's post regarding the TF. I'd reiterate that bulls and bears alike may be in for some nasty maneuvers in the zone between 892 and 912 on this Index, until price price breaks and holds out of this area one way or the other, as shown on the updated 4 Hour chart below.

Advance/Decline Issues Index

I last wrote about the Advance/Decline Issues Index on January 25th. I had mentioned that any closes above the -1000 level appear to represent general buying opportunities, and that if we started to see more Weekly closes below that level, it may be signifying that some serious selling has begun in equities.

The Weekly chart below of this Index shows that weekly closes are still occurring well above that level, with most of them above the zero level since the last week in December 2012. This past week was no exception. This tells me that there are still buyers in the equity market.

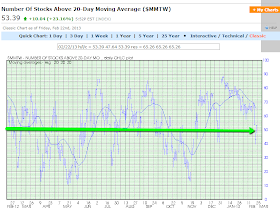

Number of Stocks Above 20-50-200-Day Moving Averages

The following three Daily charts depict the Number of Stocks Above their 20-50-200-Day Moving Averages. There is still room for all stocks, in general, to continue moving up before they run into major resistance/overbought levels. However, in the shorter-term, stocks may stall once the 65.00 level is reached on the 20-Day Moving Average chart, as price may be influenced by the downtrending 20-day moving average.

NYSI Summation Index

There has been a bearish cross of the Stochastics indicator on the Weekly chart below of the NYSI Summation Index, hinting that there may be a pullback in the SPX. However, the SPX may experience a bit more buying, pushing the NYSI higher to around the 2012 highs before we see a pullback in this Index...caution is warranted on both the bull and bear side of the trade.

30-Year Bonds

Price is holding slightly below major support, as shown on the 5-Year Weekly chart below of 30-Year Bonds. Whether it is forming a bear flag remains to be seen. A close, hold and rally above this resistance level would negate such a formation, but wouldn't guarantee that price won't breach this level once more. Despite the large volumes of the past few weeks, the drop below this resistance level has been small in comparison.

U.S. $

As shown on the 5-Year Weekly chart below of the U.S. $, price continued to rally this past week to close just below major resistance at 82.00. A break and hold above this level could send it higher to 82.78 and 83.45. Near-term support lies around its 50 weekly sma at 80.76 and a bit lower at 80.00.

China's Shanghai Index

Following China's New Year's celebrations (the markets were closed for one week), the Shanghai Index fell when it re-opened this past week, as shown on the Daily chart below. Near-term support sits in the vicinity of 2300-2250.

Summary

In summary, it appears that equity markets positioned themselves more defensively this past week (buying into the "defensive" Sectors, Bonds, and the U.S. $, while taking some profits in higher-risk sectors), possibly in response to Wednesday's FOMC minutes, and in anticipation of the results of the upcoming budget talks, which revolve around "sequestration" that will otherwise take effect next Friday. No doubt, markets are also awaiting the results of the elections in Italy this weekend and the ensuing reaction of markets in Europe and China. Also on tap next week, is month-end and its attendant machinations. Furthermore, market participants will likely be listening for any kind of clarification from Ben Bernanke (if he's questioned about it) on when the Fed may alter its bond-buying program when he testifies before the Senate Banking Committee this Tuesday and the House Financial Services Committee on Wednesday.

With so much at issue, we will likely see a further increase in intraday volatility for the coming week(s), which is why I'll be watching the charts above for clues in overall equity strength or weakness. We may also see whether market participants begin to support Gold, Platinum, the Commodities Sector, and the AUD/USD, as I wrote about earlier in the week here, which may have an influence on equities, as well.

Have a great weekend and good luck next week!