Here's what I wrote one year ago about 2011:

"2011...what a year! A year of social unrest, demonstrations, riots, government overthrows, mass murders, earthquakes, tsunamis, floods, nuclear reactor meltdowns, political discord, economic distress (the "R" word has resurfaced), austerity, financial weakness, credit rating downgrades, volatility, financial fraud, law suits, assassinations, and the passing of Steve Jobs...no wonder the markets have been so reactive (sometimes quite violently) rather than proactive in a measured manner."

and

"The question will be whether stability returns to the European markets and

whether recent stability can hold and improve in Emerging Markets for 2012, or

whether volatility (VIX) will rise again...the VIX is still elevated, so there

is a good possibility that it will. No doubt, all market action will be

reflective of upcoming world news events, as well as consumer and investor

sentiment, together with risk vs safety appetite. A couple of gauges that I'll

follow in this regard are the VIX, U.S. $, and Copper, as well as the other

instruments noted above. Without benefit of major Fed QE intervention, I imagine

that next year could be range-bound...within this year's high and low,

generally...although unforeseen catastrophes could send the Major Indices below

this year's lows."

2012 has been slightly quieter -- just remove the words "nuclear reactor meltdowns, and the passing of Steve Jobs," but repeat the rest. Add to the mix the fact that (a) Central Banks around the world have poured huge amounts of monetary stimulus into the markets, (b) there have been a variety of government elections around the world, and (c) the markets have gone through a Presidential/Congressional election in the U.S. and have faced turmoil related to the "Fiscal Cliff" and "Debt Ceiling Limit" issues -- and you get the following results on the U.S. Major Indices.

WELCOME

Welcome and thank you for visiting!

The charts, graphs and comments in my Trading Blog represent my technical analysis and observations of a variety of world markets...

* Major World Market Indices * Futures Markets * U.S. Sectors and ETFs * Commodities * U.S. Bonds * Forex

N.B.

* The content in my articles is time-sensitive. Each one shows the date and time (New York ET) that I publish them. By the time you read them, market conditions may be quite different than that which is described in my posts, and upon which my analyses are based at that time.

* My posts are also re-published by several other websites and I have no control as to when their editors do so, or for the accuracy in their editing and reproduction of my content.

* In answer to this often-asked question, please be advised that I do not post articles from other writers on my site.

* From time to time, I will add updated market information and charts to some of my articles, so it's worth checking back here occasionally for the latest analyses.

DISCLAIMER: All the information contained within my posts are my opinions only and none of it may be construed as financial or trading advice...please read my full Disclaimer at this link.

Dots

* If the dots don't connect, gather more dots until they do...or, just follow the $$$...

Bird & Cherry Blossoms

ECONOMIC EVENTS

UPCOMING (MAJOR) U.S. ECONOMIC EVENTS...

***2025***

* Wed. May 7 @ 2:00 pm ET - FOMC Rate Announcement + Forecasts and @ 2:30 pm ET - Fed Chair Press Conference

*** CLICK HERE for link to Economic Calendars for all upcoming events.

Monday, December 31, 2012

Good-bye 2012...Hello 2013!

A hearty thanks to all who visited my Blog in 2012! Tune in again next year!

Happy New Year 2013...may all your dreams come true!

Happy New Year 2013...may all your dreams come true!

Friday, December 28, 2012

Money Flow for December Week 4

Further to my last weekly market update, this week's update will look at:

Last week I said:

"In summary, we may continue to see volatile intraday/overnight swings with little follow-through on lower volumes, until the "Fiscal Cliff" issue is settled and until the end of the year, as fund managers re-organize their portfolios for the 2012 year-end and Q4. At the moment, equity markets still appear to be hedged in Bonds and the U.S. $ as they trade near major resistance levels...this will likely continue until a convincing and sustained breakout occurs in equities. As well, I continue to watch the Fed monetary stimulus program "canaries" and the 1.3250ish resistance level on the EUR/USD forex pair as possible indicators of equity weakness that may become a cause for concern by bulls...at the moment, they are signalling caution, as I discussed in those two articles this week."

This past week, volatility increased and there was profit-taking in all of the above, with the exception of the U.S. $, Euro, and 30-Year Bonds, as will be shown on the following charts and graphs...there will be no commentary, as they are self-explanatory.

In summary, we may continue to see a repeat of last week's increase in volatility, profit-taking in equities, and hedging in the U.S. $ and Bonds, until some sort of resolution of the "Fiscal Cliff" and the Debt Ceiling Limit issues are reached that satisfies the markets. We'll have to wait and see what comes from discussions and any votes held by politicians over the weekend (or beyond).

I intend to publish another article after Monday's close that summarizes the market action for Q4 and for 2012.

Happy New Year and good luck next week!

- 6 Major Indices

- 9 Major Sectors

- Index/Volatility Ratio Charts

- 30-Year Bonds

- U.S. $

- EUR/USD

- Fed Monetary Stimulus Program "Canaries"

Last week I said:

"In summary, we may continue to see volatile intraday/overnight swings with little follow-through on lower volumes, until the "Fiscal Cliff" issue is settled and until the end of the year, as fund managers re-organize their portfolios for the 2012 year-end and Q4. At the moment, equity markets still appear to be hedged in Bonds and the U.S. $ as they trade near major resistance levels...this will likely continue until a convincing and sustained breakout occurs in equities. As well, I continue to watch the Fed monetary stimulus program "canaries" and the 1.3250ish resistance level on the EUR/USD forex pair as possible indicators of equity weakness that may become a cause for concern by bulls...at the moment, they are signalling caution, as I discussed in those two articles this week."

This past week, volatility increased and there was profit-taking in all of the above, with the exception of the U.S. $, Euro, and 30-Year Bonds, as will be shown on the following charts and graphs...there will be no commentary, as they are self-explanatory.

6 Major Indices

9 Major Sectors

Index/Volatility Ratio Charts

30-Year Bonds

U.S. $

EUR/USD

Fed Monetary Stimulus Program "Canaries"

In summary, we may continue to see a repeat of last week's increase in volatility, profit-taking in equities, and hedging in the U.S. $ and Bonds, until some sort of resolution of the "Fiscal Cliff" and the Debt Ceiling Limit issues are reached that satisfies the markets. We'll have to wait and see what comes from discussions and any votes held by politicians over the weekend (or beyond).

I intend to publish another article after Monday's close that summarizes the market action for Q4 and for 2012.

Happy New Year and good luck next week!

I Smell Another Credit Rating Downgrade Coming Soon...

With both parties in disagreement on reaching a comprehensive "Fiscal Cliff" deal that aggressively reduces government spending and raises taxes, and with the "Debt Ceiling Limit" about to be breached (and probably inflated to unimaginable, out-of-control levels), I smell another U.S. credit rating downgrade coming soon...possibly to ring in the New Year.

I think "government inaction/complacency/impotency with power turned over to the Central Bank" would best describe 2012...for most countries of the world.

Who's in charge?

I think "government inaction/complacency/impotency with power turned over to the Central Bank" would best describe 2012...for most countries of the world.

Who's in charge?

Thursday, December 27, 2012

Even Cindy the Mouse Pays Her Own Way

Even Cindy the mouse knows she has to pay her own way...a seemingly foreign concept to U.S. politicians...

Wednesday, December 26, 2012

Update on SPX/VIX 2012 Complacency Odds

My post of February 28th of this year gave an 80% chance of another spike on the VIX this year. While that scenario threatened to occur mid-year, volatility subsided and has remained relatively quiet this year. However, with only three trading days left, I thought I'd provide an update on this topic.

The Weekly chart below shows the VIX pushing up against a major resistance level around 20.00. A close and hold above 20.00 may produce such a spike...if not this year, then in (possibly early) 2013.

The Weekly ratio chart of the SPX:VIX shows that the SPX has weakened on rising volatility, that price has fallen below a major support level, and that the Momentum indicator has fallen below zero again, after failing to continue pushing to new highs.

The Weekly comparison chart below of the SPX and the VIX confirms that volatility is overtaking any former strength of the SPX at the moment.

All in all, these three charts are worth tracking over the next few days/weeks, particularly as the "Fiscal Cliff" issue remains unresolved and the "Debt Ceiling Limit" is fast approaching, giving extra fuel to the high odds of another spike in the VIX, sooner rather than later. After all, Ben Bernanke did say recently that Fed monetary policy alone cannot solve America's unemployment and economic woes...a change in fiscal policies will be required, and without bi-partisan cooperation on these (and many other such) issues, I would say we'll see a spike in the VIX at some point soon.

The Weekly chart below shows the VIX pushing up against a major resistance level around 20.00. A close and hold above 20.00 may produce such a spike...if not this year, then in (possibly early) 2013.

The Weekly ratio chart of the SPX:VIX shows that the SPX has weakened on rising volatility, that price has fallen below a major support level, and that the Momentum indicator has fallen below zero again, after failing to continue pushing to new highs.

The Weekly comparison chart below of the SPX and the VIX confirms that volatility is overtaking any former strength of the SPX at the moment.

All in all, these three charts are worth tracking over the next few days/weeks, particularly as the "Fiscal Cliff" issue remains unresolved and the "Debt Ceiling Limit" is fast approaching, giving extra fuel to the high odds of another spike in the VIX, sooner rather than later. After all, Ben Bernanke did say recently that Fed monetary policy alone cannot solve America's unemployment and economic woes...a change in fiscal policies will be required, and without bi-partisan cooperation on these (and many other such) issues, I would say we'll see a spike in the VIX at some point soon.

Japan's Nikkei Approaching Major Resistance Levels

The Weekly chart below shows that Japan's Nikkei E-mini Futures Index is just below major resistance levels. We may start to see choppy (and potentially volatile) trading from today's (Wednesday's) high of 10390 up to 10900-11300ish until it either pulls back or continues upwards.

As you can see, it's had great difficulty staying above the 10390 level since the index began its rally after the lows of 2008/09. We'll see whether the government's money-printing program continues to translate into a continued equity push up, in spite of these technical limitations/constraints.

As you can see, it's had great difficulty staying above the 10390 level since the index began its rally after the lows of 2008/09. We'll see whether the government's money-printing program continues to translate into a continued equity push up, in spite of these technical limitations/constraints.

Tuesday, December 25, 2012

Monday, December 24, 2012

Sunday, December 23, 2012

"A Visit From St. Nicholas"

ON THIS DAY ~ December 23, 1823 (the following is courtesy of Wikipedia):

A Visit from St. Nicholas

The poem, "arguably the best-known verses ever written by an American",[5] was first published anonymously in the Troy, New York, Sentinel on December 23, 1823, and was reprinted frequently thereafter with no name attached. Moore later acknowledged authorship and the poem was included in an 1844 anthology of his works[6] at the insistence of his children, for whom he wrote it.

A Visit from St. Nicholas is largely responsible for the conception of Santa Claus from the mid-nineteenth century to today, including his physical appearance, the night of his visit, his mode of transportation, the number and names of his reindeer, and the tradition that he brings toys to children. Prior to the poem, American ideas about St. Nicholas and other Christmastide visitors varied considerably. The poem has influenced ideas about St. Nicholas and Santa Claus beyond the United States to the rest of the English-speaking world and beyond. Since 1911 the Church of the Intercession in Manhattan has held a service that includes the reading of the poem followed by a procession to the tomb of Clement Clarke Moore at Trinity Cemetery the Sunday before Christmas.[7][8]

Moore's connection with the poem has been questioned by Professor Donald Foster, an expert on textual content analysis, who used external and internal evidence to argue that Moore could not have been the author.[9] Major Henry Livingston, Jr., a New Yorker with Dutch and Scottish roots, is considered the chief candidate for authorship, if Moore did not write it. Livingston was distantly related to Moore's wife.[9]

A Visit from St. Nicholas

Main article: A Visit from St. Nicholas

The poem, "arguably the best-known verses ever written by an American",[5] was first published anonymously in the Troy, New York, Sentinel on December 23, 1823, and was reprinted frequently thereafter with no name attached. Moore later acknowledged authorship and the poem was included in an 1844 anthology of his works[6] at the insistence of his children, for whom he wrote it.

A Visit from St. Nicholas is largely responsible for the conception of Santa Claus from the mid-nineteenth century to today, including his physical appearance, the night of his visit, his mode of transportation, the number and names of his reindeer, and the tradition that he brings toys to children. Prior to the poem, American ideas about St. Nicholas and other Christmastide visitors varied considerably. The poem has influenced ideas about St. Nicholas and Santa Claus beyond the United States to the rest of the English-speaking world and beyond. Since 1911 the Church of the Intercession in Manhattan has held a service that includes the reading of the poem followed by a procession to the tomb of Clement Clarke Moore at Trinity Cemetery the Sunday before Christmas.[7][8]

Moore's connection with the poem has been questioned by Professor Donald Foster, an expert on textual content analysis, who used external and internal evidence to argue that Moore could not have been the author.[9] Major Henry Livingston, Jr., a New Yorker with Dutch and Scottish roots, is considered the chief candidate for authorship, if Moore did not write it. Livingston was distantly related to Moore's wife.[9]

Friday, December 21, 2012

Money Flow for December Week 3

Further to my last weekly market update, this week's update will look at:

Inasmuch as today (Friday) was a Quadruple Options Expiration, I'm showing the following chartgrid, where each candle represents a 1-month options expiration period. You can see that the current candle, which closed today, basically, bounced at/near the mid-Bollinger Band. Price is stuck within a sideways range and is at/near major resistance.

We may see some retracement on the next candle, which begins on Monday, before these indices either attempt to break out of and hold above this range to, potentially, rally to their upper Bollinger Band, or retreat to lower levels, such as their lower Bollinger/50 sma confluence major support levels. You will note that the Dow Transports is already at its upper Bollinger Band and the Russell 2000 is just below.

I'd watch the Russell 200 for either leadership in a push upwards or a pullback.

The following Year-to-date Weekly chartgrid shows the extent of this week's gains, as does the following 1-Week percentage gained/lost graph.

The largest gains were made in the Dow Transports and Russell 2000 Indices.

The first chartgrid also depicts a 1-month options expiration period, with the current candle closing today. You can see that all sectors retraced some or all of the prior period's pullback. They are all in either longer or shorter-term sideways ranges, and are also at/near major resistance, with Consumer Discretionary, Consumer Staples, Healthcare, and Technology leading in overall gains from the 2009 lows.

We may also see some retracement on the next candle, which begins on Monday, before these indices either attempt to break out of and hold above this range to, potentially, rally to their upper Bollinger Band, or retreat to lower levels, such as their lower Bollinger/50 sma confluence major support levels.

I'd watch the Consumer Discretionary and Staples, Healthcare, and Technology Sectors for either continued leadership in a push upwards or a pullback.

The following Year-to-date Weekly chartgrid shows the extent of this week's gains/losses, as does the following 1-Week percentage gained/lost graph.

The largest gains were made in the Financials Sector, while Consumer Staples lost some ground.

Normally I'd show Daily charts, but have opted to show the following 2-Year Weekly ratio charts comparing the SPX, RUT, and NDX to their respective Volatility Indices.

You can see that each one closed roughly in the middle of its weekly candle, after a week of what was particularly high volatility for the SPX...basically indicating indecision and lack of commitment in either direction in these markets. The SPX:VIX and NDX:VXN ratio pairs closed below major resistance (broken horizontal blue line), while the RUT:RVX ratio pair closed just above.

With volumes expected to be lower overall next week during the Christmas holidays, we could actually see an increase in volatility with large moves and little follow-through...probably something we'll continue to see until a deal is (presumably) reached before the end of the year on the "Fiscal Cliff" issue.

The Weekly chart below of 30-Year Bonds shows that price also finished near the middle of this week's candle and is back in the middle of a longer-term sideways trading range from mid-May...so, there is no indication of panic selling in these bonds, yet.

The Weekly chart below of the U.S. $ shows that price finished near the top of this week's candle and at the Volume Profile POC (point of control) for the past 5 years. It's been in a 2-point trading range since mid-September, and remains the risk-on/risk-off trade, along with 30-Year Bonds.

In summary, we may continue to see volatile intraday/overnight swings with little follow-through on lower volumes, until the "Fiscal Cliff" issue is settled and until the end of the year, as fund managers re-organize their portfolios for the 2012 year-end and Q4. At the moment, equity markets still appear to be hedged in Bonds and the U.S. $ as they trade near major resistance levels...this will likely continue until a convincing and sustained breakout occurs in equities. As well, I continue to watch the Fed monetary stimulus program "canaries" and the 1.3250ish resistance level on the EUR/USD forex pair as possible indicators of equity weakness that may become a cause for concern by bulls...at the moment, they are signalling caution, as I discussed in those two articles this week.

Merry Christmas and have a safe and Happy Holiday week. Good luck to anyone trading next week!

- 6 Major Indices

- 9 Major Sectors

- Index/Volatility Ratio Charts

- 30-Year Bonds

- U.S. $

6 Major Indices

Inasmuch as today (Friday) was a Quadruple Options Expiration, I'm showing the following chartgrid, where each candle represents a 1-month options expiration period. You can see that the current candle, which closed today, basically, bounced at/near the mid-Bollinger Band. Price is stuck within a sideways range and is at/near major resistance.

We may see some retracement on the next candle, which begins on Monday, before these indices either attempt to break out of and hold above this range to, potentially, rally to their upper Bollinger Band, or retreat to lower levels, such as their lower Bollinger/50 sma confluence major support levels. You will note that the Dow Transports is already at its upper Bollinger Band and the Russell 2000 is just below.

I'd watch the Russell 200 for either leadership in a push upwards or a pullback.

The following Year-to-date Weekly chartgrid shows the extent of this week's gains, as does the following 1-Week percentage gained/lost graph.

The largest gains were made in the Dow Transports and Russell 2000 Indices.

9 Major Sectors

The first chartgrid also depicts a 1-month options expiration period, with the current candle closing today. You can see that all sectors retraced some or all of the prior period's pullback. They are all in either longer or shorter-term sideways ranges, and are also at/near major resistance, with Consumer Discretionary, Consumer Staples, Healthcare, and Technology leading in overall gains from the 2009 lows.

We may also see some retracement on the next candle, which begins on Monday, before these indices either attempt to break out of and hold above this range to, potentially, rally to their upper Bollinger Band, or retreat to lower levels, such as their lower Bollinger/50 sma confluence major support levels.

I'd watch the Consumer Discretionary and Staples, Healthcare, and Technology Sectors for either continued leadership in a push upwards or a pullback.

The following Year-to-date Weekly chartgrid shows the extent of this week's gains/losses, as does the following 1-Week percentage gained/lost graph.

The largest gains were made in the Financials Sector, while Consumer Staples lost some ground.

Index/Volatility Ratio Charts

Normally I'd show Daily charts, but have opted to show the following 2-Year Weekly ratio charts comparing the SPX, RUT, and NDX to their respective Volatility Indices.

You can see that each one closed roughly in the middle of its weekly candle, after a week of what was particularly high volatility for the SPX...basically indicating indecision and lack of commitment in either direction in these markets. The SPX:VIX and NDX:VXN ratio pairs closed below major resistance (broken horizontal blue line), while the RUT:RVX ratio pair closed just above.

With volumes expected to be lower overall next week during the Christmas holidays, we could actually see an increase in volatility with large moves and little follow-through...probably something we'll continue to see until a deal is (presumably) reached before the end of the year on the "Fiscal Cliff" issue.

30-Year Bonds

The Weekly chart below of 30-Year Bonds shows that price also finished near the middle of this week's candle and is back in the middle of a longer-term sideways trading range from mid-May...so, there is no indication of panic selling in these bonds, yet.

U.S. $

The Weekly chart below of the U.S. $ shows that price finished near the top of this week's candle and at the Volume Profile POC (point of control) for the past 5 years. It's been in a 2-point trading range since mid-September, and remains the risk-on/risk-off trade, along with 30-Year Bonds.

In summary, we may continue to see volatile intraday/overnight swings with little follow-through on lower volumes, until the "Fiscal Cliff" issue is settled and until the end of the year, as fund managers re-organize their portfolios for the 2012 year-end and Q4. At the moment, equity markets still appear to be hedged in Bonds and the U.S. $ as they trade near major resistance levels...this will likely continue until a convincing and sustained breakout occurs in equities. As well, I continue to watch the Fed monetary stimulus program "canaries" and the 1.3250ish resistance level on the EUR/USD forex pair as possible indicators of equity weakness that may become a cause for concern by bulls...at the moment, they are signalling caution, as I discussed in those two articles this week.

Merry Christmas and have a safe and Happy Holiday week. Good luck to anyone trading next week!

Boehner's (Merry?) Christmas Gift to Americans

Very simply, no deal.

After John Boehner's 'Plan B' failed to garner support among his own Republican party members and the House vote was cancelled, the S&P 500 Futures Index dropped 50 points last night in a matter of minutes and global indices around the world are deeply in the red this morning.

Gee, I wonder whose thinking is "bizarre and irrational" in the "Fiscal Cliff" negotiations? In his prepared 10:00 am press conference speech today, Boehner turned the resolution of the "Fiscal Cliff" issue over to the President and said "Merry Christmas"...I guess he has no more ideas.

It does not sound like he and his Republicans are willing to compromise on a deal.

Merry Christmas, indeed!

After John Boehner's 'Plan B' failed to garner support among his own Republican party members and the House vote was cancelled, the S&P 500 Futures Index dropped 50 points last night in a matter of minutes and global indices around the world are deeply in the red this morning.

Gee, I wonder whose thinking is "bizarre and irrational" in the "Fiscal Cliff" negotiations? In his prepared 10:00 am press conference speech today, Boehner turned the resolution of the "Fiscal Cliff" issue over to the President and said "Merry Christmas"...I guess he has no more ideas.

It does not sound like he and his Republicans are willing to compromise on a deal.

Merry Christmas, indeed!

Thursday, December 20, 2012

Holding My Breath...

As this is the eve of the "2012 Phenomenon," I'm holding my breath...

"See you tomorrow" takes on a whole new meaning!

"See you tomorrow" takes on a whole new meaning!

***UPDATE December 21, 2012 @ 12:00 pm: Well, the world is still here...so far, so good...but the day does not end until midnight...to be continued...

***UPDATE December 22, 2012 @ 7:00 am: Whew (exhaled)...yep...still here! :-)

Wednesday, December 19, 2012

"Canaries" About To Fall Off Their Perch?

My three Fed Stimulus Program "Canaries" are beginning to lose steam after today's (Wednesday's) gap up and fade on negatively diverging RSI, as shown on the Daily ratio charts below.

Such is also the case on the European and Chinese Financials ETFs (compared with their respective country's Major Index), as shown on the following Daily ratio charts.

Perhaps the noxious gases from the "Fiscal Cliff" discussions are beginning to have an effect, as traders take profits, before the U.S., potentially, goes over the cliff at the end of this month. Both political parties seem as far apart as ever, with no resolution in sight.

Such is also the case on the European and Chinese Financials ETFs (compared with their respective country's Major Index), as shown on the following Daily ratio charts.

Perhaps the noxious gases from the "Fiscal Cliff" discussions are beginning to have an effect, as traders take profits, before the U.S., potentially, goes over the cliff at the end of this month. Both political parties seem as far apart as ever, with no resolution in sight.

Meanwhile, the SPX:VIX ratio closed below major support (broken blue horizontal line) today, as volatility increased. Momentum has hooked down and is below zero again, so I'd look for increasing volatility, with the heightened probability of further downside on the SPX.

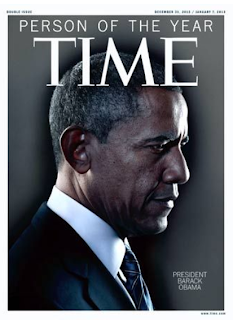

Obama Gets "No Respect"

Since markets rallied after that remark, I can only assume that they see "going over the cliff" as a positive.

He really should just pack up and go on vacation.

***UPDATE: By the end of the day, equity markets declined and closed at/near their low of the day...the see-saw continues.

***UPDATE December 21, 2012 ~ Boehner's (Merry?) Christmas gift to Americans: After John Boehner's 'Plan B' failed to garner support among his own Republican party members and the House vote was cancelled, the S&P 500 Futures Index dropped 50 points last night in a matter of minutes and global indices around the world are deeply in the red this morning. Gee, I wonder whose thinking is "bizarre and irrational" in the "Fiscal Cliff" negotiations? In his prepared 10:00 am press conference speech today, Boehner turned the resolution of the "Fiscal Cliff" issue over to the President and said "Merry Christmas"...I guess he has no more ideas. It does not sound like he and his Republicans are willing to compromise on a deal. Merry Christmas, indeed!

Tuesday, December 18, 2012

Obama Should Just Wax Up His Surfboard and Go!

In my humble opinion, President Obama should just wax up his surfboard and go away on holidays now...let the markets force a resolution to the "Fiscal Cliff" issue.

It's time for the silly political self-serving theatrics on both sides to end...hohohum...bug!

Do you know where your money is going? http://www.usdebtclock.org/

It's time for the silly political self-serving theatrics on both sides to end...hohohum...bug!

Do you know where your money is going? http://www.usdebtclock.org/

Monday, December 17, 2012

EUR/USD Approaching a Confluence of Resistance

The EUR/USD forex pair is approaching a confluence of resistance at 1.3200-1.3250ish as it rallies towards the underside of a former "diamond" pattern/apex, as shown on the Weekly chart below. I'd expect to see a bull/bear tug-of-war around this level before it either continues upward, or reverses somewhat.

It is, currently, still under the bearish influence of a moving average "Death Cross" formation and, as such, is subject to further (and, potentially, large) downdrafts. Caution may be warranted at the moment, which may negatively affect, and produce a drag on, any bull scenario in U.S. equities, in the near term.

It is, currently, still under the bearish influence of a moving average "Death Cross" formation and, as such, is subject to further (and, potentially, large) downdrafts. Caution may be warranted at the moment, which may negatively affect, and produce a drag on, any bull scenario in U.S. equities, in the near term.

Subscribe to:

Posts (Atom)