- 6 Major Indices

- 9 Major Sectors

- Trendlines on 7 Major Indices

- China's Shanghai Index and the European Top 100 Index

- 30-Year bonds

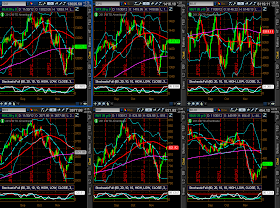

6 Major Indices

The three chartgrids below show Monthly, Weekly, and Daily timeframes of the six Major Indices, along with the Stochastics indicator. Inasmuch as today (Friday) closed out the month of November, I thought I'd show where price is relative to these timeframes.

Price is pushing up against resistance (either near-term or major, longer-term) in overbought territory on negative Stochastics divergence on the Monthly timeframe. The Stochastics indicator is bouncing up off oversold territory on the Weekly timeframe, and it is in overbought territory on the Daily timeframe.

They all closed higher on the week, as shown on the 1-Week percentage gained/lost graph below. The Utilities Index made the biggest gains, followed by the Russell 2000 Index. The Dow 30 Index was, basically, flat on the week.

9 Major Sectors

The three chartgrids below show Monthly, Weekly, and Daily timeframes of the nine Major Sectors, along with the Stochastics indicator.

As with the Major Indices above, price is also pushing up against resistance (either near-term or major, longer-term) in overbought territory on negative Stochastics divergence on the Monthly timeframe. The Stochastics indicator is bouncing up off oversold territory on the Weekly timeframe, and it is in overbought territory on the Daily timeframe.

Seven of the nine Major Sectors closed higher on the week, as shown on the 1-Week percentage gained/lost graph below. The Utilities Sector made the biggest gains, while losses were made in the Energy and Financials Sectors...slightly favouring the "Defensive" sectors.

Trendlines on 7 Major Indices

Below are Weekly charts of 7 of the Major Indices, with a major trendline shown on each (discussed in last Friday's weekly market update), which begins from the October lows of 2011.

This week, the SPX tested both sides of its break back above its trendline (which it made last week) and closed above it for the second week in a row. It's important for the SPX to hold above 1400 and this major trendline in order to continue to support a bull case. The RUT and the OEX closed on the underside of their respective trendlines today and will need to cross and hold above to support any further rally on the SPX. The NDX and the three Dow Indices have yet to backtest their major trendlines.

What may interfere with a continued rally next week is the overbought reading on the Stochastics indicator on the Daily timeframes on the Major Indices and Major Sectors, as I mentioned above. We may see a bit of a pullback to relieve such a situation, before they, potentially, continue what is, traditionally, a Christmas rally.

However, market participants may be expecting further monetary stimulus measures to be announced at the next FOMC meeting on December 12th, and a potential resolution of the "Fiscal Cliff" issue before Congress begins its vacation on December 14th, so we may not see a pullback until we get closer to Christmas, and possibly the end of the year.

Intraday volatility has been varying wildly recently from large, swift swings to narrow, compressed ranges, with price moving on news events...making for schizophrenic and unpredictable moves...not surprising with the Major Indices and Sectors pushing up against major resistance on Monthly timeframes in overbought territory, as well as the unresolved "Fiscal Cliff" issue (and looming Debt Ceiling issue), seasonal factors (Christmas/Boxing Day market closures), upcoming unemployment data on December 7th, Options Expiration (Quadruple Witching) on December 21st, and end of Q4 on December 31st. I expect this type of volatility to continue until the end of the year, and possibly into next year...particularly, until the Monthly overbought Stochastics cycle has reversed and been resolved on the Major Indices and Sectors.

We may also see a continuation of unusual buying of beaten-down, high-beta stocks, as has been occurring recently in the Social Media stocks and RIMM, as I mentioned in my post of November 24th, as fund managers attempt to top up their yearly portfolio gains before the end of the year. I'll be looking for any parabolic rise and climax on high volumes on stocks such as these as a precursor to a potential major market trend reversal. If this type of stock continues to explode higher in the near-term versus value stocks, I'll also be warned of potential Q4 earnings weakness (markets favouring beta-movers versus actual value). Here's an updated Daily shot of how they ended this week...FB is leading the rally in this group.

China's Shanghai Index and the European Top 100 Index

The Shanghai Index continues to make new lows, while the European Top 100 Index remains range-bound at major resistance levels, as shown on the Daily charts below. These are two other indices I'm following, as further weakness in China, and any further weakening economic data coming out of Europe could depress any further meaningful advance on the U.S. markets (unemployment continues to rise unabated in Europe, which will, no doubt, be exacerbated by further austerity measures that may be imposed on EU countries). Any further stimulus measures that may be forthcoming from the ECB would be announced at their upcoming rate announcement and press conference on December 6th.

30-Year Bonds

Price on the Weekly chart below of 30-Year Bonds closed on Friday just above near-term support, after retesting a level just below. Failure to hold this support level may induce serious bond-selling, which could begin on a larger scale if price then failed to hold at the next support level (around the lower Bollinger Band/50 sma). Any substantial weakening of Bonds may produce a large-scale rally in equities...one to watch over the next days/weeks.

Enjoy your weekend and good luck next week!