Pages

▼

Wednesday, October 31, 2012

Euro Area Unemployment Rate Rises to 11.6%

Data released today shows that unemployment continues to rise unabated in the Euro Area, and now sits at 11.6%, as shown on the graph below. It's been rising since the lows in 2007 and is well above the levels seen in January 2000. For details of the report, click here.

So far, the ECB's LTRO 1 & 2 programs have not resolved the unemployment problem in the Euro Area...for that matter, neither have the actions of the EU, to date.

In the meantime, the STOX50 remains range-bound within a zone of major resistance below the 2011 highs, as shown on the Daily chart below. Price is swirling around the 50 sma, but declining RSI, MACD, and Stochastics Indicators are indicating weakness within this zone.

In the absence of encouraging and co-ordinated political, economic, fiscal, and financial actions/reform by EU countries, I expect this Index to decline and, potentially, test the uptrend line, which currently sits at 2350.

So far, the ECB's LTRO 1 & 2 programs have not resolved the unemployment problem in the Euro Area...for that matter, neither have the actions of the EU, to date.

In the meantime, the STOX50 remains range-bound within a zone of major resistance below the 2011 highs, as shown on the Daily chart below. Price is swirling around the 50 sma, but declining RSI, MACD, and Stochastics Indicators are indicating weakness within this zone.

In the absence of encouraging and co-ordinated political, economic, fiscal, and financial actions/reform by EU countries, I expect this Index to decline and, potentially, test the uptrend line, which currently sits at 2350.

Price Action on the TF Wednesday a.m.

This morning's intraday price action on the Russell 2000 E-mini Futures Index (TF) on this, the first day of re-opening the NYSE for trading post-Hurricane Sandy, has been non-committal, frenetic, choppy, and gappy...price has not ventured very far above or below the 9:30 a.m. open and is just slightly below at the moment...not unexpected, I suppose since it's also the end of the month and year-end for some...volumes have also been lighter...looks like we're awaiting a return to full power in the N.E. of the U.S. and a return of all market participants...now awaiting delayed oil data (tentatively re-scheduled for Thursday) and unemployment data on Friday...could be choppy until then.

Tuesday, October 30, 2012

Best Wishes, America!

Best wishes, America, in your recovery in the wake of Hurricane Sandy! My thoughts and prayers are with you.

Markets have been closed since Monday due to the hurricane. Below is an update of the YM, ES, NQ & TF e-mini futures indices, with the last two days (comprised of Globex-hours trading only) signalling a potential reversal. We'll need further clarification during full market-hours trading when that resumes (scheduled for Wednesday). All four are now below their channels from the June lows, and any bounce may only be testing the bottom of the channel before resuming a downward trek.

Markets have been closed since Monday due to the hurricane. Below is an update of the YM, ES, NQ & TF e-mini futures indices, with the last two days (comprised of Globex-hours trading only) signalling a potential reversal. We'll need further clarification during full market-hours trading when that resumes (scheduled for Wednesday). All four are now below their channels from the June lows, and any bounce may only be testing the bottom of the channel before resuming a downward trek.

Saturday, October 27, 2012

Support and Resistance Levels (Oct. 27, 2012)

Below are a variety of instruments with support and resistance levels shown on them...some are Weekly and some are Daily charts. There is no commentary, as they should be self-explanatory.

Friday, October 26, 2012

Money Flow for October Week 4

Further to my last weekly market update, this week's update will look at:

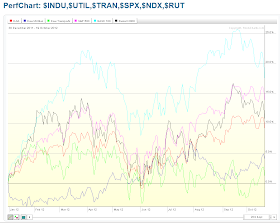

All six Major Indices closed this past week lower, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Dow 30 lost the most, followed by the Dow Utilities, S&P 500, Russell 2000, Dow Transports, and Nasdaq 100.

All nine Major Sectors also closed the week lower, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Materials Sector lost the most, followed by Energy, Financials, Utilities, Consumer Discretionary, Industrials, Technology, Consumer Staples, and Health Care...with the "Defensive" Sectors, essentially, losing the least.

Generally, the Major Indices and Major Sectors are trading around/near their mid-Bollinger Band on the Weekly timeframe. The next level of support would be the lower Bollinger Band once they've reached an oversold condition on their Stochastics Indicator...several are in that vicinity already, but have yet to cross up with positive divergence. It may take such a situation to occur before any buying with conviction (and higher volumes) returns to these markets.

On a Daily timeframe, I'm watching for a break and hold below the last swing low (on the following three ratio charts comparing the SPX, RUT, and NDX with their respective Volatility Indices) to indicate that further selling/weakness is occurring on accelerating volatility momentum. The Momentum indicator is still in bearish territory below the zero level on all three charts, and price is currently in a "bear flag" formation.

Depicted on the following Daily ratio charts are comparisons of the S&P 500 Index with other World Indices. I've drawn in support and resistance levels, as well as trendlines on price and the RSI, MACD, and Stochastics indicators, which are self-explanatory. The only comment I will make is a general observation that the SPX has weakened compared to all of them, either in the past few days, couple of weeks, couple of months, or from mid-2012. This is actually shown most clearly on the first chart which compares the SPX with the World Index...price has been in decline from mid-year, and currently remains beneath the 200 sma (red).

The big question is whether the SPX resumes a leadership role compared to these other indices in the next few days, weeks, or even months. We may see further comparative weakness until the U.S. election has taken place and the Fiscal Cliff issue resolved. Either way, it will be interesting to see where the SPX ends up by the end of this year as either a world index leader or a laggard.

Enjoy your weekend and good luck next week!

- 6 Major Indices

- 9 Major Sectors

- 3 Ratio Charts of the SPX:VIX, RUT:RVX, and NDX:VXN

- A comparison of the SPX to other World Indices

6 Major Indices

All six Major Indices closed this past week lower, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Dow 30 lost the most, followed by the Dow Utilities, S&P 500, Russell 2000, Dow Transports, and Nasdaq 100.

9 Major Sectors

All nine Major Sectors also closed the week lower, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Materials Sector lost the most, followed by Energy, Financials, Utilities, Consumer Discretionary, Industrials, Technology, Consumer Staples, and Health Care...with the "Defensive" Sectors, essentially, losing the least.

Generally, the Major Indices and Major Sectors are trading around/near their mid-Bollinger Band on the Weekly timeframe. The next level of support would be the lower Bollinger Band once they've reached an oversold condition on their Stochastics Indicator...several are in that vicinity already, but have yet to cross up with positive divergence. It may take such a situation to occur before any buying with conviction (and higher volumes) returns to these markets.

3 Ratio Charts of the SPX:VIX, RUT:RVX, and NDX:VXN

On a Daily timeframe, I'm watching for a break and hold below the last swing low (on the following three ratio charts comparing the SPX, RUT, and NDX with their respective Volatility Indices) to indicate that further selling/weakness is occurring on accelerating volatility momentum. The Momentum indicator is still in bearish territory below the zero level on all three charts, and price is currently in a "bear flag" formation.

SPX vs. Other World Indices

Depicted on the following Daily ratio charts are comparisons of the S&P 500 Index with other World Indices. I've drawn in support and resistance levels, as well as trendlines on price and the RSI, MACD, and Stochastics indicators, which are self-explanatory. The only comment I will make is a general observation that the SPX has weakened compared to all of them, either in the past few days, couple of weeks, couple of months, or from mid-2012. This is actually shown most clearly on the first chart which compares the SPX with the World Index...price has been in decline from mid-year, and currently remains beneath the 200 sma (red).

The big question is whether the SPX resumes a leadership role compared to these other indices in the next few days, weeks, or even months. We may see further comparative weakness until the U.S. election has taken place and the Fiscal Cliff issue resolved. Either way, it will be interesting to see where the SPX ends up by the end of this year as either a world index leader or a laggard.

Enjoy your weekend and good luck next week!

AAPL vs. NDX

I'm watching this ratio chart of AAPL vs. NDX...to see if AAPL's weakness relative to the NDX continues and whether downside momentum accelerates as the Momentum indicator drops below zero at the time of publishing this post today (Friday).

Friday's GDP

Data released today (Friday) shows a rise in the Advance GDP numbers, as shown on the graph below.

There was also a rise in the Advance GDP Price Index numbers, as shown on the graph below.

This link to the details of the GDP released by the U.S. Department of Commerce Bureau of Economic Analysis says that: "The acceleration in real GDP in the third quarter primarily reflected an upturn in federal government spending, a downturn in imports, an acceleration in PCE, a smaller decrease in private inventory investment, an acceleration in residential fixed investment, and a smaller decrease in state and local government spending that were partly offset by downturns in exports and in nonresidential fixed investment."

This Tweet by Bloomberg's Economics Editor summarizes the above:

There was also a rise in the Advance GDP Price Index numbers, as shown on the graph below.

This link to the details of the GDP released by the U.S. Department of Commerce Bureau of Economic Analysis says that: "The acceleration in real GDP in the third quarter primarily reflected an upturn in federal government spending, a downturn in imports, an acceleration in PCE, a smaller decrease in private inventory investment, an acceleration in residential fixed investment, and a smaller decrease in state and local government spending that were partly offset by downturns in exports and in nonresidential fixed investment."

This Tweet by Bloomberg's Economics Editor summarizes the above:

Thursday, October 25, 2012

China's Leading Index Dropped from 1.7% to 0.3%

Data released Wednesday night shows a decline in China's Leading Index from 1.7% to 0.3%, as shown on the graph below.

Since this index is designed to predict the direction of the economy and is a combined reading of six economic indicators related to total loans issued, raw material supplies index, new orders, consumer expectations, export orders, and housing, it's an important index to monitor, particularly since this latest reading is one of the lowest since May of 2010.

Since this index is designed to predict the direction of the economy and is a combined reading of six economic indicators related to total loans issued, raw material supplies index, new orders, consumer expectations, export orders, and housing, it's an important index to monitor, particularly since this latest reading is one of the lowest since May of 2010.

The Last E-mini Standing

While three of the four E-mini Futures Indices have broken below the bottom of their uptrending channel, which began in June of this year, the TF is still (just) holding within, as shown on the Daily charts below...the one to watch for signs of increasing weakness over the next few days.

As of today's (Thursday's) close, momentum is still below the zero level on the following three Daily ratio charts of the SPX, RUT, and NDX vs. their respective Volatility Indices. Price action over the past 5+ days looks like a bear flag...watching for a break and hold below the bottom of the flag and the resumption of an acceleration in volatility momentum.

As of today's (Thursday's) close, momentum is still below the zero level on the following three Daily ratio charts of the SPX, RUT, and NDX vs. their respective Volatility Indices. Price action over the past 5+ days looks like a bear flag...watching for a break and hold below the bottom of the flag and the resumption of an acceleration in volatility momentum.

Wednesday, October 24, 2012

No Fireworks on Fed Day

There were no fireworks in the markets as the results of today's Fed meeting were released...volumes were low...no change to yesterday's outlook. My WAG is more selling ahead for FB, AAPL (earnings coming out tomorrow), and GS.

Simply Astonishing...

I wonder what he thinks constitutes an assault against a woman?

No wonder women get upset when anti-abortion laws are forced upon them! These laws are, essentially, pro-bullying laws, which constitute unwarranted (and excessively) invasive and subjective force against women, in my opinion. In fact, I would argue that a woman holds exclusive rights to her body...those rights include the right to excise foreign matter...since a fetus is comprised partly of foreign DNA and the woman's DNA, she (and only she), therefore, has the right to decide to terminate her pregnancy. The courts simply have no jurisdiction on such matters...and neither do the Church and politicians.

Tuesday, October 23, 2012

Monthly/Weekly/Daily Cycles on Major Indices

Looking at a top-down view of the 6 Major Indices, I would note the following.

Monthly View

Weekly View

Daily View

In the short term, we may see a bit of a bounce, but medium and longer term, these Indices may continue their downward trek to alleviate their overbought conditions on their Weekly and Monthly timeframes.

The following ratio charts comparing the SPX, the RUT, and the NDX to their respective Volatility Indices show that, while a lower swing low has now been made and the Momentum Indicator (MOM) is below the zero level, each one is sitting at or just above a support level on the Daily timeframe. Increasing volatility will confirm any further selling in these 3 Indices. Of particular interest is the fact that MOM has made a lower swing low on the SPX:VIX to confirm the lower low on price, whereas it has not on the RUT:RVX and NDX:VXN...suggesting that today's (Tuesday's) selling momentum on the SPX accelerated at a greater pace than on the RUT & NDX...ones to watch during any further pullback to confirm an acceleration of the selling momentum.

Monthly View

- all just below the top of their recent highs

- Stochastics indicator is in overbought territory, except for DJT & DJU which is neutral

- major support is at the bottom Bollinger Band, which, generally, lies in the vicinity of the Monthly 50 sma (red)

- while the 50 sma is still (just) above the 200 sma on the SPX, it has recently crossed below on the ES, so it's now officially under the bearish influences of a "Death Cross" formation on the Monthly timeframe

Weekly View

- all at/near their mid-Bollinger Band

- Stochastics indicator is not yet in oversold territory on 5 of the Indices...NDX is now oversold

- major support sits around the vicinity of the Weekly 50 sma (red)

Daily View

- DJI, SPX, NDX & RUT are at/below their lower Bollinger Band

- DJT is in between its upper and mid-Bollinger Band

- DJU is just below its mid-Bollinger Band

- Stochastics indicator is in oversold territory on DJI, SPX, NDX & RUT

- DJT & DJU are neither overbought nor oversold

- major support sits at the Monthly 200 sma (pink

In the short term, we may see a bit of a bounce, but medium and longer term, these Indices may continue their downward trek to alleviate their overbought conditions on their Weekly and Monthly timeframes.

The following ratio charts comparing the SPX, the RUT, and the NDX to their respective Volatility Indices show that, while a lower swing low has now been made and the Momentum Indicator (MOM) is below the zero level, each one is sitting at or just above a support level on the Daily timeframe. Increasing volatility will confirm any further selling in these 3 Indices. Of particular interest is the fact that MOM has made a lower swing low on the SPX:VIX to confirm the lower low on price, whereas it has not on the RUT:RVX and NDX:VXN...suggesting that today's (Tuesday's) selling momentum on the SPX accelerated at a greater pace than on the RUT & NDX...ones to watch during any further pullback to confirm an acceleration of the selling momentum.

Take 2 Tablets and Call Me in the Morning...

Just what the world needs to solve all of its headaches...another tablet as Apple Inc. gets ready to unveil its iPad mini later today.

Any advances above 500.00 since late February of this year have been getting cannibalized on AAPL. The volumes above 400.00 in the Volume Profile along the right edge of the Weekly chart below are, virtually, non-existent, so I wonder what's holding the price up.

Make mine a double-double!

UPDATE (Oct. 25/12): With prices starting at $329.00 for their new iPad mini, I think Apple Inc. will struggle to compete with other (cheaper) brands.

Monday, October 22, 2012

Japan's Trade Balance at New 12-Year Low

Data released Sunday night revealed a big drop in Japan's Trade Balance...in fact, it's the lowest reading since January 2000 and double the loss made the prior month. Whether the Bank of Japan will provide additional monetary easing/stimulus remains to be seen.

Japan's Nikkei Index has been fluctuating wildly within a wide range since it dropped below 10000 after the earthquake in March of 2011. Two attempts to regain and hold above that level have failed, and price remains subdued within a smaller range and in between the 50 and 200 smas, as shown on the Daily chart below. The 50 sma is still below the 200 sma in a bearish "Death Cross" formation, and price action is under that bearish influence.

Japan's Nikkei Index has been fluctuating wildly within a wide range since it dropped below 10000 after the earthquake in March of 2011. Two attempts to regain and hold above that level have failed, and price remains subdued within a smaller range and in between the 50 and 200 smas, as shown on the Daily chart below. The 50 sma is still below the 200 sma in a bearish "Death Cross" formation, and price action is under that bearish influence.

Sunday, October 21, 2012

Saturday, October 20, 2012

Support and Resistance Levels (Oct. 20, 2012)

Below are a variety of instruments with support and resistance levels shown on them...some are Weekly and some are Daily charts. There is no commentary, as they should be self-explanatory.

Friday, October 19, 2012

Money Flow for October Week 3

Further to my last weekly market update, this week's update will look at:

(a) Percentage Gains/Losses for the past week, as well as

(b) Year-to-Date Leaders/Laggards of the various instruments within each group for 2012

for the following groups:

6 Major Indices

All six Major Indices bounced at the beginning of the week, only to decline into Friday's close, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Dow Utilities gave up the least of its weekly gains, while the Nasdaq 100 lost the most.

The Year-to-Date percentage gained/lost graph below shows that the Nasdaq 100 is the leader, while the Dow Transports is the laggard (and only just in positive territory), so far, for 2012.

9 Major Sectors

Similarly, all 9 Major Sectors bounced at the beginning of the week, only to decline into Friday's close, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Materials Sector gave up the least of its weekly gains, while the Technology Sector lost the most.

The Year-to-Date percentage gained/lost graph below shows that the Financials Sector is the leader, while the Utilities Sector is the laggard, so far, for 2012.

Germany, France and the PIIGS Indices

The 1-Week percentage gained/lost graph below shows that the Greek Index gained the most on the week, while Ireland gained the least.

The Year-to-Date percentage gained/lost graph below shows that the Greek Index is the leader, while the Spanish Index is the laggard (and in negative territory), so far, for 2012.

Emerging Markets ETF (EEM) and the BRIC Indices

The 1-Week percentage gained/lost graph below shows that China's Shanghai Index gained the most on the week, while India lost the most.

The Year-to-Date percentage gained/lost graph below shows that the Indian Index is the leader, while the Shanghai Index is the laggard (and in negative territory), so far, for 2012.

Canada, Japan, Britain, and World Market Indices

The 1-Week percentage gained/lost graph below shows that Japan's Index gained the most on the week, while Canada's Index gained the least.

The Year-to-Date percentage gained/lost graph below shows that the World Index is the leader, while Canada's Index is the laggard, so far, for 2012.

Commodity and Agriculture ETFs (DBC and DBA), Gold, Oil, Copper, and Silver

The 1-Week percentage gained/lost graph below shows that of the two ETFs, DBC lost, while DBA gained on the week. Of the actual Commodity Futures, Silver lost the most, while Oil lost the least.

The Year-to-Date percentage gained/lost graph below shows that Silver is the leader, while Oil is the laggard (and in negative territory), so far, for 2012. DBC is slightly ahead of DBA in terms of percentage gained for the year (DBA is just above flat).

7 Major Currencies

The 1-Week percentage gained/lost graph below shows that the Aussie $ gained the most on the week, while the Canadian $ lost the most. The U.S. $ was flat.

The Year-to-Date percentage gained/lost graph below shows that the British Pound is the leader, while the Japanese Yen is the laggard (and in negative territory), so far, for 2012. The U.S. $ and the Euro are, essentially flat.

Ratio Chart of SPX:VIX

This Year-to-Date Daily ratio chart of the SPX vs. the VIX shows that price has, once again, closed below the bottom of the rising channel and trendline, and has made a lower swing low. The Momentum indicator has also crossed below the zero level. Further price action below Friday's close will signal a further rise in volatility, along with more selling in the S&P 500 Index.

Ratio Chart of RUT:RVX

This Year-to-Date Daily ratio chart of the RUT vs. the RVX shows that price has, also, closed below the bottom of the rising channel, and has made a lower swing low. The Momentum indicator also crossed below the zero level. Further price action below Friday's close will signal a further rise in volatility, along with more selling in the Russell 2000 Index.

U.S. $

Price closed on this Weekly chart of the U.S. $ just below an important major resistance level of 80.00 and is holding above an important support level of 79.00. A recapture and hold above 80.00 will likely add to the selling pressure on equities.

30-Year Bonds

Price is holding above a confluence of price/Bollinger Band/50sma support at the 144'30 level. Further buying above Friday's close will likely add to the selling pressure on equities.

In summary, for the coming week, I'd repeat what I said in my last weekly summary...namely, if we see a major breakdown in Commodities and a rally in the U.S. $ and 30-Year Bonds, we may see a further pullback in equities, and there will be a rise in Volatility. This past week, we've seen:

In other groups:

Also, since the FOMC meeting is this coming Wednesday, and we're now in Q3 Earnings Season (some of which have already been well below analyst expectations), we may see more volatile intraday swings between now and then, particularly as tension builds heading into the U.S. Presidential election on November 6th (the last Presidential debate is this coming Monday), along with concerns about the impending U.S. Fiscal Cliff scenario, public and political/economic/fiscal unrest in some European countries, and rising tensions in the Middle East and between China and Japan.

Fund managers may seek safety in the U.S. $ and 30-Year Bonds, while reducing their holdings in the Year-to-Date "group leaders" as a defensive measure against further weakness/selling in those groups. In this regard, at risk are:

Enjoy your weekend and good luck next week!

(a) Percentage Gains/Losses for the past week, as well as

(b) Year-to-Date Leaders/Laggards of the various instruments within each group for 2012

for the following groups:

- 6 Major Indices

- 9 Major Sectors

- Germany, France and the PIIGS Indices

- Emerging Markets ETF (EEM) and the BRIC Indices

- Canada, Japan, Britain, and World Market Indices

- Commodity and Agriculture ETFs (DBC and DBA), Gold, Oil, Copper, and Silver

- 7 Major Currencies

- Ratio Charts of SPX:VIX and RUT:RVX

- U.S. $

- 30-Year Bonds

6 Major Indices

All six Major Indices bounced at the beginning of the week, only to decline into Friday's close, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Dow Utilities gave up the least of its weekly gains, while the Nasdaq 100 lost the most.

The Year-to-Date percentage gained/lost graph below shows that the Nasdaq 100 is the leader, while the Dow Transports is the laggard (and only just in positive territory), so far, for 2012.

9 Major Sectors

Similarly, all 9 Major Sectors bounced at the beginning of the week, only to decline into Friday's close, as shown on the Weekly charts below.

The 1-Week percentage gained/lost graph below shows that the Materials Sector gave up the least of its weekly gains, while the Technology Sector lost the most.

The Year-to-Date percentage gained/lost graph below shows that the Financials Sector is the leader, while the Utilities Sector is the laggard, so far, for 2012.

Germany, France and the PIIGS Indices

The 1-Week percentage gained/lost graph below shows that the Greek Index gained the most on the week, while Ireland gained the least.

The Year-to-Date percentage gained/lost graph below shows that the Greek Index is the leader, while the Spanish Index is the laggard (and in negative territory), so far, for 2012.

Emerging Markets ETF (EEM) and the BRIC Indices

The 1-Week percentage gained/lost graph below shows that China's Shanghai Index gained the most on the week, while India lost the most.

The Year-to-Date percentage gained/lost graph below shows that the Indian Index is the leader, while the Shanghai Index is the laggard (and in negative territory), so far, for 2012.

Canada, Japan, Britain, and World Market Indices

The 1-Week percentage gained/lost graph below shows that Japan's Index gained the most on the week, while Canada's Index gained the least.

The Year-to-Date percentage gained/lost graph below shows that the World Index is the leader, while Canada's Index is the laggard, so far, for 2012.

Commodity and Agriculture ETFs (DBC and DBA), Gold, Oil, Copper, and Silver

The 1-Week percentage gained/lost graph below shows that of the two ETFs, DBC lost, while DBA gained on the week. Of the actual Commodity Futures, Silver lost the most, while Oil lost the least.

The Year-to-Date percentage gained/lost graph below shows that Silver is the leader, while Oil is the laggard (and in negative territory), so far, for 2012. DBC is slightly ahead of DBA in terms of percentage gained for the year (DBA is just above flat).

7 Major Currencies

The 1-Week percentage gained/lost graph below shows that the Aussie $ gained the most on the week, while the Canadian $ lost the most. The U.S. $ was flat.

The Year-to-Date percentage gained/lost graph below shows that the British Pound is the leader, while the Japanese Yen is the laggard (and in negative territory), so far, for 2012. The U.S. $ and the Euro are, essentially flat.

Ratio Chart of SPX:VIX

This Year-to-Date Daily ratio chart of the SPX vs. the VIX shows that price has, once again, closed below the bottom of the rising channel and trendline, and has made a lower swing low. The Momentum indicator has also crossed below the zero level. Further price action below Friday's close will signal a further rise in volatility, along with more selling in the S&P 500 Index.

Ratio Chart of RUT:RVX

This Year-to-Date Daily ratio chart of the RUT vs. the RVX shows that price has, also, closed below the bottom of the rising channel, and has made a lower swing low. The Momentum indicator also crossed below the zero level. Further price action below Friday's close will signal a further rise in volatility, along with more selling in the Russell 2000 Index.

U.S. $

Price closed on this Weekly chart of the U.S. $ just below an important major resistance level of 80.00 and is holding above an important support level of 79.00. A recapture and hold above 80.00 will likely add to the selling pressure on equities.

30-Year Bonds

Price is holding above a confluence of price/Bollinger Band/50sma support at the 144'30 level. Further buying above Friday's close will likely add to the selling pressure on equities.

In summary, for the coming week, I'd repeat what I said in my last weekly summary...namely, if we see a major breakdown in Commodities and a rally in the U.S. $ and 30-Year Bonds, we may see a further pullback in equities, and there will be a rise in Volatility. This past week, we've seen:

- selling in Gold, Oil, Copper and Silver

- the U.S. $ regain most of its weekly losses

- an end-of-week bounce in 30-Year bonds

- a failure of U.S. Major Indices and Sectors to hold onto most of their mid-week gains

- a 2.11% decline in the Technology Sector, along with a 1.54% decline in the Nasdaq 100 Index

- within the Major Indices group, the Nasdaq 100 Index is the Leader for 2012 and is the one to watch for signs of further weakness, as mentioned in my post of October 16th, which warns of a potential Technology bubble

In other groups:

- the Greek Index has gained the most (in terms of percentage) during 2012 and the past week (one to watch for signs of weakness)

- The Shanghai Index has gained the most during the past week, but is still in negative territory for 2012...the one to watch for any signs of stabilization, as it has not yet bottomed, as mentioned in my post of October 18th

- EEM was unable to hold onto its initial gains and closed almost flat for the week...one to watch for further signs of weakness, as mentioned in my post of October 17th, concerning the formations of a large Weekly and smaller Daily Head & Shoulders patterns

- Britain's FTSE 100 Index is facing major technical and fundamental resistance at the top of its very large and, potential, topping pattern, as mentioned in my post of October 18th...one to watch for signs of further weakness after some profit-taking began on Friday

Also, since the FOMC meeting is this coming Wednesday, and we're now in Q3 Earnings Season (some of which have already been well below analyst expectations), we may see more volatile intraday swings between now and then, particularly as tension builds heading into the U.S. Presidential election on November 6th (the last Presidential debate is this coming Monday), along with concerns about the impending U.S. Fiscal Cliff scenario, public and political/economic/fiscal unrest in some European countries, and rising tensions in the Middle East and between China and Japan.

Fund managers may seek safety in the U.S. $ and 30-Year Bonds, while reducing their holdings in the Year-to-Date "group leaders" as a defensive measure against further weakness/selling in those groups. In this regard, at risk are:

- Nasdaq 100 Index

- Financials Sector

- Greek Index

- Indian Index

- World Index

- DBC (Commodities ETF)

- Silver

- British Pound

Enjoy your weekend and good luck next week!