Further to my last weekly market update, this week's update can be summed up in three words...more profit-taking.

The following Weekly charts and graphs (for the past week) of the 6 Major Indices and 9 Major Sectors show that these markets have not advanced for a second week as they struggle at major resistance.

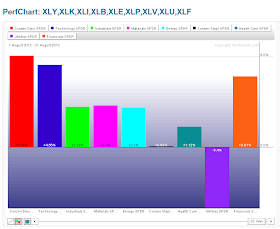

The following two charts and graphs depict money flow for the month of August. You can see that the majority of interest/buying occurred in the riskier growth-oriented Technology and Small Cap Indices and Sectors versus a virtual non-interest in the value-oriented defensive Indices and Sectors.

In summary, whether we'll see a rotation of Sector preference in September remains to be seen. I suspect that market action will, generally, be news-driven as we await important decisions by the Fed, ECB, Germany's Constitutional Court ruling on the legality of the ESM, Eurogroup meetings, further economic data, the Dutch election, and any fall-out from the U.S. election campaigning, etc.

Since this tends to produce volatility, I'll continue to monitor it as depicted by the following Daily ratio charts of the SPX:VIX and RUT:RVX. As of Friday's close, both the S&P 500 and Russell 2000 Indices are sitting near the apex of trendline/channel resistance/support. Volatility has been rising the past two weeks and a break of the apex one way or the other is inevitable soon. We may see a build in volumes as price tries to establish a trend away from the apex...something else I'll be monitoring in order to assess the viability/sustainability of such a move. Perhaps we'll see a rotation into the more defensive Sectors and Large Cap Indices in preparation for volatility.

Enjoy the long weekend and best of luck next week!