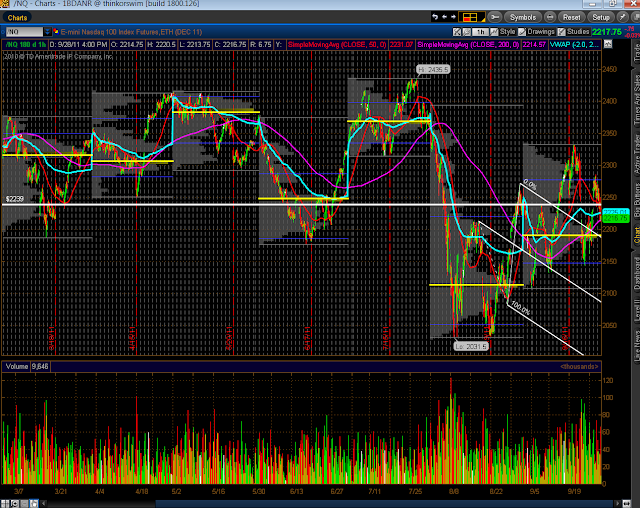

Below are 60 min (trading hours only) charts of the YM, ES, TF & NQ. Overlayed on each chart are:

- 50 sma (red) and 200 sma (pink)

- Monthly VWAP (turquoise)

- Monthly Volume Profiles (the yellow horizontal line is the POC)

- Andrews' Pitchfork (white)

- Volumes

For the YM:

- price filled Tuesday's upside gap today on heavy selling volumes which began late yesterday...what was a potential "island bottom" has now been eliminated

- the 50 sma crossed below the 200 sma last Friday, forming a death cross again...the 200 sma was re-tested Tuesday, Wednesday and today before price closed today immediately below the 50 sma

- price has re-tested the upper end of the downtrending pitchfork several times and has failed to hold above on all occasions...in fact, it has sold off on high volumes each time consistent with the levels that were made during the various declines which began in May of this year...price is currently just above the "mean"

- price is trading below the September Monthly VWAP and the September Monthly Volume Profile POC...and ended today at last month's POC and below last month's VWAP

- price remains weak and is vulnerable to heavy selling below each of the aforementioned studies, and is currently within the one-day range that was established on August 8th (the Monday after the S&P U.S. credit rating downgrade)

For the ES:

- price filled Tuesday's upside gap today on heavy selling volumes which began late yesterday...what was a potential "island bottom" has now been eliminated

- the 50 sma crossed below the 200 sma on Monday of this week, forming a death cross again...the 200 sma was re-tested Tuesday, Wednesday and today before price closed today below the 50 sma

- price has re-tested the upper end of the downtrending pitchfork several times and has failed to hold above on all occasions...in fact, it has sold off on high volumes each time consistent with the levels that were made during the various declines which began in May of this year...price is currently just above the "mean"

- price is trading below the September Monthly VWAP and the September Monthly Volume Profile POC...and ended today immediately above last month's POC and below last month's VWAP

- price remains weak and is vulnerable to heavy selling below each of the aforementioned studies, and is currently within the one-day range that was established on August 8th (the Monday after the S&P U.S. credit rating downgrade)

For the TF:

- price filled Tuesday's upside gap today on heavy selling volumes which began late yesterday...what was a potential "island bottom" has now been eliminated

- the 50 sma crossed below the 200 sma , forming a death cross again last Friday...the 200 sma was re-tested Tuesday before price closed today below the 50 sma

- price has re-tested the upper end of the downtrending pitchfork several times and has failed to penetrate and hold above on all occasions...in fact, it has sold off on high volumes each time consistent with the levels that were made during the various declines which began in May of this year...price is currently below the "mean"

- price is trading below the September Monthly VWAP and the September Monthly Volume Profile POC...and ended today below last month's POC and VWAP, as well

- price remains weak and is vulnerable to heavy selling below each of the aforementioned studies, and is currently within the one-day range that was established on August 8th (the Monday after the S&P U.S. credit rating downgrade)...it is the weakest of the four e-mini futures indices

For the NQ:

- price filled Tuesday's upside gap today on heavy selling volumes which began late yesterday...what was a potential "island bottom" has now been eliminated

- the 50 sma is still above the 200 sma, but both are in the process of merging with the September Monthly VWAP and are forming a confluence zone

- price is currently trading above the downtrending pitchfork...however it has sold off on high volumes after a variety of rallies each time consistent with the levels that were made during the various declines which began in July of this year

- price is trading below the September Monthly VWAP and above the September Monthly Volume Profile POC...and ended today above last month's POC and VWAP, as well

- price remains weak and is vulnerable to heavy selling in its current confluence zone, and is currently within the one-day range that was established on August 5th (the day of the S&P U.S. credit rating downgrade)...it is the strongest of the four e-mini futures indices at the moment

While technology is still the "flavour of the day," it is not immune to comparable sell-offs like the one we saw today as shown on the one-day comparison chart below of the Dow 30, S&P 500, Russell 2000, and Nasdaq 100:

So, at the moment, weakness prevails in the YM, ES, TF & NQ.