Speaking of paying, it looks like some banks are faced with a lawsuit filed by FHFA...see today's Wall Street Journal article:

Three of the banks mentioned are on the Weekly chartgrid below of GS, C, XLF & JPM. GS, XLF & JPM are "riding on the edge" of the -2 deviation level of an uptrending regression channel that started at their lows after the major market correction in 2008/09, while C has fallen below and is "clinging to the edge" by its fingernails. What happens in the coming weeks will be of great interest to me relative to this channel.

Below are 2 Weekly charts...one of EUR/CHF & one of EUR/USD...as can be seen, the Euro is in a longer-term downtrend against these two currencies, albeit at different levels of weakness. I'll be watching to see how the correlation between these two charts plays out in the coming days and weeks and if the Euro continues its decline.

The Weekly chart below of Gold shows that price found support at a Fibonacci confluence level of 1700ish and resistance at another of 1900ish. Where it goes from here relative to the above currency pairs and the financials will also be of interest.

Oil is trading in between several Fibonacci confluence levels of 90.00ish and 80.00ish as shown on the Weekly chart below...a breakout in either direction may correlate to what happens in the above currency and financial markets.

EEM has fallen below its "mean" of its uptrending regression channel (which began in October 2007) on the Weekly chart below after testing it twice in the past couple of weeks. Near-term support is the flat-to-falling 200sma, which appears to be a critical level since July 2009...another one I'll be watching over the next few weeks relative to the charts above.

Below is a Weekly chartgrid of YM, ES, NQ & TF. This week, the candle formed a bear harami shooting star on the YM, ES & TF, and a gravestone on the NQ. Price closed just below the -1 deviation level on the YM & ES, below on the TF, and just above on the NQ. Price is currently in the bottom portion of the upper one-third of the range from the lows in March 2009 and their highs of this year on the YM & ES, in the upper portion of the middle one-third on the TF, and is just below the middle of the upper one-third of the NQ. For a closer look at where price is relative to this year's highs on these 4 e-minis, I've put up a final chart below this one.

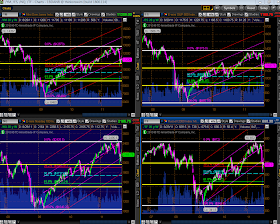

Below is a 4-hourly chartgrid of the YM, ES, NQ & TF. Overlayed on each chart are 2 regression channels. The longer downtrending channel runs from the beginning of May of this year for the YM, ES & TF and began in late July for the NQ. The shorter uptrending channel began on August 8. I made reference to this chart in yesterday's post. Today, price closed below the "mean" on the longer channel for the YM, ES & TF, and is still holding above the "mean" on the NQ. However, price is now below the "mean" of the shorter channel on all 4 e-minis. Furthermore, price has now closed in the lower one-third of the range taken from this year's high to low on the YM & ES, is well within the lower one-third on the TF, and is in the lower portion of the middle one-third on the NQ...all in all, a bearish end to the week as price has closed below the top of the initial bounce that was made after August 8.

These are some of the charts that I'll be watching next week and in the days and weeks to come to see whether the equities markets continue their decline, along with the Euro, the financials, EEM and Oil, while money continues to flow into Gold, the US$ and the Swiss Franc.

No doubt, future news events will be just as conflicting as they have been of late...

So, buckle up...

And watch out for the surprise that lurks below...