So, there we have it...the Fed's downgraded economic outlook for the U.S. today confirmed Standard & Poor's recent credit rating downgrade. Apart from holding rates low for the next two years for the benefit of the banks with the likely net result of higher inflation to be brought about by a rise again in equity, oil and commodity prices, I don't see any net benefit for the average American...economic growth has slowed, consumer spending has slowed, the housing market remains depressed, unemployment has grown, and the national debt continues to accelerate at enormous rates. As I mentioned in yesterday's post below, fixing these problems lies with America's politicians. So far, I haven't seen any evidence that they've done the job that they were elected to do...and, so far, I don't have any confidence that they'll actually solve anything that produces quantifiable results before the next federal election. Why do I say that? Because they have not been able to work together to produce something meaningful for the average American since the last election...in fact, things have gotten worse. That's how I see the truth of the matter.

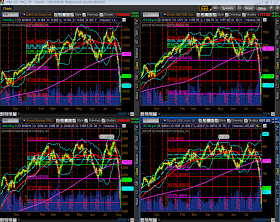

How do I translate today's actions by the Fed and the markets' reactions into how I continue to daytrade the TF? Also, how will I know if the plunge in price on the YM, ES, NQ & TF from July to yesterdays lows was simply the "C" of an ABC correction on the overall uptrend since the March 2009 lows, or if it is the first leg down and the beginning of a new downtrend on the Daily charts?

To help answer those questions and to help me navigate through the current minefield of super volatility which creates huge and wild intraday swings, I'll be looking at a number of things during the day. However, before I get into that, I would mention that Goldman Sachs has said they have a year-end price target of 1400 for the S&P 500 (http://www.marketwatch.com/story/goldman-sachs-cuts-sp-500-target-to-1400-2011-08-08). Such a move up in the markets would make sense in that it would tie in neatly with the November deadline that Mr. Obama has set for the "Gang of Six" to figure out how to cut more money from the national debt...no doubt inflation would be up again and their solution would be to raise taxes...not on the rich, but on the average American.

The Daily charts below of the YM, ES, NQ & TF show that, from the lows to the highs of this year, price has hit the following external Fibonacci retracement levels:

YM = 161.8%+

ES = 200%+

NQ = 161.8%+

TF = 200%+

I'll be watching to see what type of intraday channels form within this range and price action within, as well as price reaction around overhead resistance areas...to that end, the NQ is already at this year's former lows which have now formed resistance.

I'll keep an eye on price action on the various Volatility Indices shown on the Daily chartgrid below, as well as what type of intraday channels build from this recent large move up...also whether they're able to hold their price above their March 2011 highs.

Below is a Daily chart of the US$...price remains stable, so far, around the 74.00 level and is currently just above the "mean" of a longer downtrending regression channel and just below the -1 deviation level of a shorter downtrending regression channel. Any further weakening on the dollar will, no doubt, signal a further rise in equities. If the dollar fell to a level that would be considered unacceptable by the Fed, I imagine that they would change their new policy of keeping rates low until mid-2013 and raise interest rates before then, instead...thus, the average American could be hit with the prospect of, not only higher taxes and goods, but also higher interest rates on their personal debt.

If there is a substantial and sustained blow-off in the price of Gold, it will be interesting to see whether any cash profits are re-routed into the US$, particularly if there is a chance that interest rates will go up. My Daily chart below of Gold shows that, today, price hit a 61.8% Fibonacci fan line that began in October 2008...so far price has not retreated, but the move is becoming parabolic.

Below is a Weekly chart of Oil. Price is currently tangled up in a confluence of Fibonacci levels. Any meaningful reversal on this latest move down would have to occur above the 86.00 level...that would put it back up to the -1 deviation level of the uptrending regression channel with the potential of sending it up to the +1 deviation level.

Financials gained some ground today as shown on the Weekly charts below of GS, C, XLF & JPM...price also rose back up into the uptrending regression channel. A sustained rise in these would confirm a rise in equities.

The Daily chart below of CRX shows a bounce today off a Fibonacci extension level...above is a resistance of Fibonacci confluence around the 880-890 level. A rise above that would go hand-in-hand with a rise in equities.

These are some of the things I'll be watching over the next while...we'll see what Mr. Market delivers tomorrow.

This little dittie reminds me of my cat, Smudge...he won't go to sleep at night until I've brushed him thoroughly and made a big fuss over him: